Product

March 15, 2013

Producer Price Index (PPI) of Sheet Steel & Competing Materials

Written by Peter Wright

Written by: Peter Wright

Producer price indexes, (PPI), of sheet steel and competing materials. Each month the Bureau of Labor Statistics (BLS) puts out its series of producer price indexes, for thousands of goods and materials. The latest release on Thursday reported February results. Some of the PPI are helpful in monitoring the competitive price of steel and steel products against competing materials and products. As far as we can tell from comparison with real world prices, these indexes are a good representation of the real world.

The headline on Thursday was that the composite PPI rose 0.7 percent in February which was more than the consensus expectation. Metals prices were an exception, partly caused by final consumer demand in China.

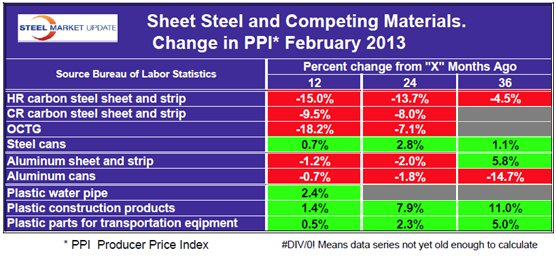

The table below is a summary of steel, aluminum and plastic indexes. Four cells in this table are blank and shaded gray. In the last two years the BLS has expanded its range of products within the PPI series with the result that long term comparisons cannot be made in these four cases. What we can see is that steel has made strong inroads against plastic in the last 12, 24 and 36 months with a relative price movement in the double digits. Aluminum prices have declined along with steel in the last two years, but not to the same extent, which also gives steel a price movement advantage. Presumably, both aluminum and plastic are negatively affected by high petroleum prices but the future energy economy of the US could work against the competitive position of steel.

An anomaly in these PPI, which some readers may understand is that the relative cost of steel food and beverage containers has not followed the PPI of steel sheet. Looking further back in time, the competitive position of steel against aluminum in this market has declined drastically since the end of 2008, the beginning of the great recession.

The above analysis is another introduction of a product which will be part of our “premium” content once our new website comes online (projected for late June 2013). The purpose of this table is to assist in projecting the competiveness of steel against aluminum and plastic in the future.