Product

March 11, 2013

Without Service Center Support Increases will Not Stick

Written by John Packard

Service Center Spot Pricing Ignores Latest Price Increase Announcements

“[Unnamed service center] They are making a big push in VA/NC HVAC market – dropping numbers all over the place. This is how a mill price increase announcement begins to die.” East Coast Distribution Company

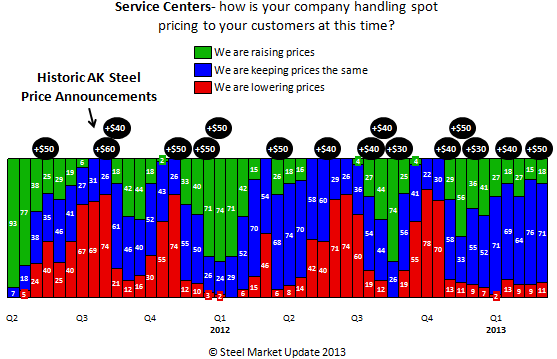

Based on the results from our most recent steel survey, service centers continue to be less than supportive of spot price increases on flat rolled steel products. During our survey process, SMU heard from the manufacturing segment of the industry which reported after this most recent price increase announcement (last week) the percent of service centers raising spot prices went from zero percent to 20 percent. At the same time service centers told SMU, during the survey process, that those increasing prices went from 15 percent to 18 percent – a 3 point increase immediately after a price increase announcement. A 3 point rise and a total percentage equaling 18 percent are not glowing recommendations that spot prices will move higher anytime soon.

As SMU has noted in the past, history has shown that without the support of the service centers raising spot prices – and in the process selling the increases into the marketplace – mill price increases are doomed and are only effective for a matter of days as opposed to weeks or months.

A Midwest service center told us last week a day or two after the U.S. Steel announcement, “…Inventories are imbalanced and service centers/distributors are selling like they are desperate to generate orders. In fact, most mill “deals” over the last 60-days have just been passed along to the end user which has only lead to margin compression and decreased value to existing inventories. In such a large and powerful industry one would expect steel mills to control pricing, but instead the market is currently being driven by the lowest common denominator. Until lead-times extend we should not expect the mills to have any control over the equation.”