Product

March 11, 2013

Price Increase Announcements Create Short-Term Volatility

Written by John Packard

Batting average is around .500 – Half Stick, Half Don’t

Remember the good old days when the domestic steel industry would announce price increases based on the flow of business – when order flows increased to a point where mill books were strained and lead times became extended and industry prices moved higher? The “new normal” is let’s throw it against the wall and see what sticks… problem is half of the “stuff” isn’t sticking and the more times you scream “fire” without a fire being there, the less serious the announcements become.

It seems price announcements have become the signal to slow down the angle of the decline and to create a temporary floor to pricing. After that, they have not been used to create any actual push to market momentum.

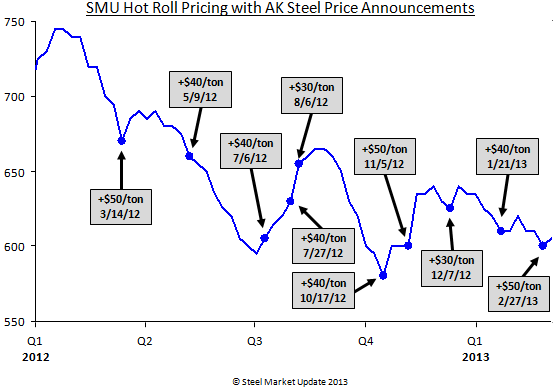

SMU thought it might be interesting to take a look at the past 15 months to see how many price increase announcements there have been and what happened to pricing immediately after the announcements were made.

We are using AK Steel as an example – however, other steel mills made price announcements during the same time period as AK (and, in some cases for higher pricing). As you can see by the graphic provided there have been 10 price announcements going back to January 2012. Added up those ten price increase announcements total $410 per ton…

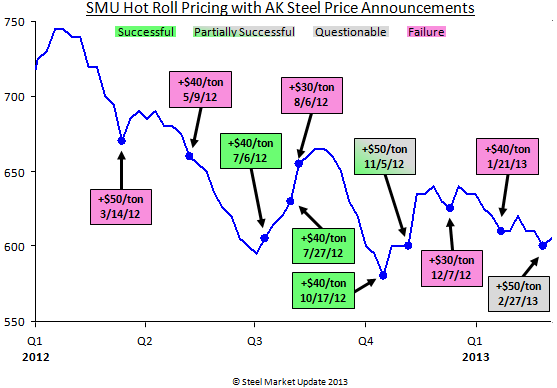

Not all of the announcements were successful. For the purpose of this report SMU is defining a “successful” increase as one where at least 75 percent of the announced amount was collected within 4 weeks of the announcement. A “partially successful” increase is when 50 percent was collected and anything less than 50 percent, without a continued upward trend after 4 weeks, are considered “failures.”

In the next graphic we have color coded the data to show you what has transpired with each of the price increase announcements based on the criteria outlined above. The November 5, 2012 is coded as “partially successful” because prices began to collapse in the fourth week after the announcement. The March 14, 2012 is coded a “failure” because it was not able to maintain at least a 50 percent increase within the first four weeks.

As you can see by our graph, the most recent price announcements going back to November 5, 2012 have created a very jagged visual as the announcements appear to create short term volatility. However, from the mill view point the announcements have stopped the indexes (which are an average, not the bottom) from breaking through the $600 per ton level. If the intent is to put a temporary bottom to the market, and that is your measure of success, then the domestic mills have been more successful than our graphic suggests.