Product

March 11, 2013

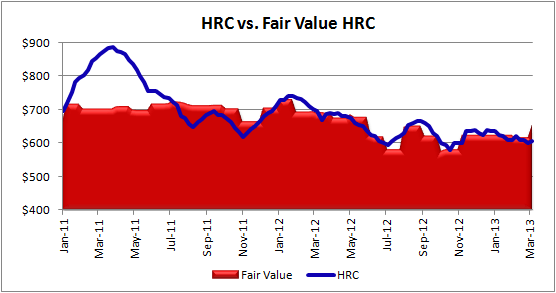

HRC Spot Pricing Below SMU Fair Value for 4th Week

Written by John Packard

This week, the SMU Fair Value HRC (hot rolled coil) Model has spot HRC pricing below Fair Value for the fourth consecutive week after rising above the Fair Value price in the week of February 8th. This is due to the SMU average spot HRC index increasing $5 per ton last week to $605 per ton and scrap inputs increasing $30 to $45 per ton for the month of March. The Fair Value model now shows HRC prices $48 below the estimated Fair Value price.

As a reminder, the Fair Value HRC Model below came from the SMU acquisition of Steel Reality. The graph below demonstrates the relationship between scraps inputs creating an estimated “Fair Value” for HRC versus the actual spot price.