Product

March 8, 2013

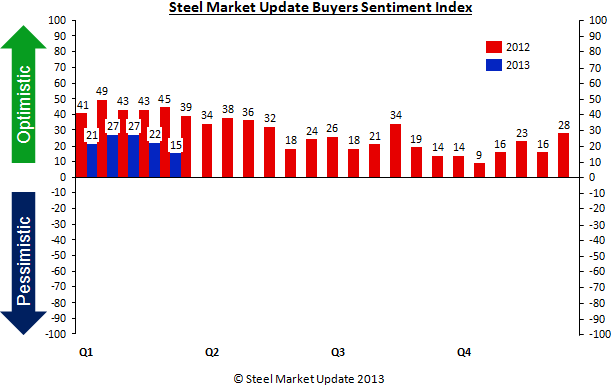

SMU Steel Buyers Sentiment Index Slips to Lowest Level of the Year

Written by John Packard

Optimism waned this week as steel buyers and sellers toiled over price announcements, demand questions and a heightened sense of insecurity regarding their company’s ability to be successful in the current market environment. Based on the results from our just completed steel market survey, SMU Steel Buyers Sentiment Index dropped 6 points to +15 from our mid-February reading. Our Index is at the lowest point since the middle of October 2012 when Sentiment was measured at +9.

The steel industry is used to having the 1st Quarter of the year as one of the stronger, if not strongest quarters for business and price appreciation. This year has been an exception. SMU Steel Buyers Sentiment Index is nowhere near the optimism levels reported during March 2012 or 2011. Sentiment was measured at +45 during the first week of March 2012 and a respectable +36 during the same period in 2011.

The steel industry is used to having the 1st Quarter of the year as one of the stronger, if not strongest quarters for business and price appreciation. This year has been an exception. SMU Steel Buyers Sentiment Index is nowhere near the optimism levels reported during March 2012 or 2011. Sentiment was measured at +45 during the first week of March 2012 and a respectable +36 during the same period in 2011.

The failure of the steel industry to control supply and demand coupled with price announcements at inopportune times are two of the reasons given by steel buyers and sellers as to why our Index has been in decline over the past two months. The price announcements, which were then not supported by the steel mills making the announcements, has impacted how those active within the industry view their chances at having success in the current market. A service center purchasing manager from a large Midwest distributor told us during the survey process:

“2000 through 2010, mill price increase announcements created order activity which typically would result in at least one additional increase announcement. Mills could site anything from rising input costs, extended lead times, natural disasters, etc. and they would immediately be successful increasing spot prices – and the cycle would run 3-4 months. Today, lead times are too short and confidence in mill discipline creates nothing but dismissed rumors. Most service centers or distributors today believe that even when increase announcements are released the mills will allow “one final order” at the previous (lower) price. A self defeating practice to the mills who only pull orders forward in a dismal market. Until we see overall demand significantly increase or mill production significantly decrease we will not see lead times extend…which will only equate to more failed mill announcements.”

The uncertainty surrounding the economies of the world appears to have created an atmosphere where companies are worried and the stock market is the only “safe” investment… (I am being somewhat facetious about the stock market)

“Although January and February yielded a definite uptick in activity, the general state of the market and economy would lead to a condition this is not provided from your choices. The term that best fits is ‘uncertain’.”– Service Center

“I think the second half of the year may be stronger than the first half. There is too much uncertainty coming out of the government policy right now for businesses to get off the sidelines.” – Manufacturing Company (agriculture products).

Our survey invites those responding to comment on each section and there was no shortage of comments regarding current business conditions and Sentiment:

“Winter weather, political uncertainty, European economy … usual suspects. At least we’re on the upswing in the US, albeit snail’s pace.”– Trading Company

“Significant margin compression amid reduced volume” – Trading Company

“Less business 2013 than same time 2012” – Manufacturing Company

“Business is unusually slow for the 1st Quarter of a year. I think the 2nd Quarter will be good. (But I thought that about the 1st Quarter and I was wrong)” – Service Center

SMU Steel Buyers Future Sentiment Index +37

We also queried about our respondents’ opinions regarding the next three to six months and if their company will be better able to be successful at that time. Our Future Sentiment Index dropped six points from the middle of February to register a +37. This is still well within the optimistic range of our index but, it is at the lowest level of the year and is at the lowest level since mid-December 2012 when we measured Future Sentiment at +33.

Looking back at the first week of March on a historical basis, Future Sentiment in March 2011 was +51 and the following year – 2012 – it was +57.

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from + 10 to + 100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently we send invitations to slightly less than 700 North American companies to participate in our survey. Our normal response rate is approximately 120-170 companies. Of those responding to this week’s survey 46 percent were manufacturing companies, 38 percent were service centers/distributors and the balance was made up of steel mills, trading companies and toll processors involved in the steel business.

Steel Market Update does canvass those being invited to participate in order to confirm their active participation in the flat rolled steel business. Our list is updated at least once per month and we are adding new companies on a continuous basis.