Product

March 8, 2013

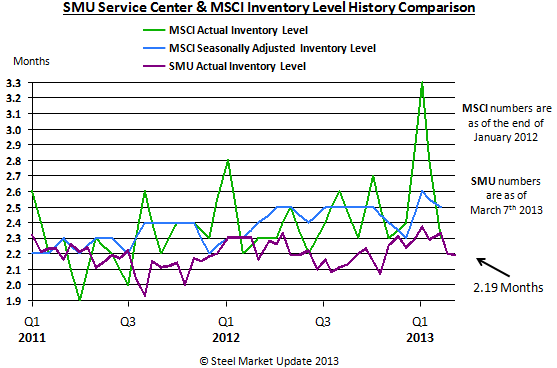

SMU Service Center Inventories Drop to 2.19 Months

Written by John Packard

Based on the results of our latest SMU steel market survey, service center flat rolled inventories (as of this week) dropped from 2.37/2.33 in January and early February to 2.19 months. We did hear from service centers during the survey process of their continued focus on lowering inventories from these levels. SMU considers large, medium and small service centers as equals regarding inventories and we do not seasonally adjust our numbers. We defer to the MSCI data as being more complete but, we feel our quick snapshot analysis provides an early look into what you can expect out of the MSCI data once released.