Product

March 8, 2013

Mill Lead Times Relatively Flat – Negotiations Continue (except Galvalume)

Written by John Packard

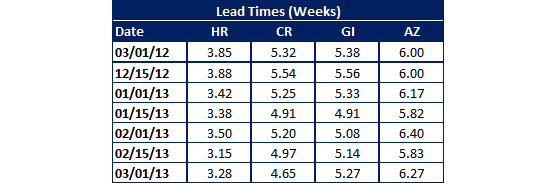

Mill lead times grew only fractionally since the price increase announcements which began on Tuesday of this past week. Based on our SMU steel market survey results, hot rolled lead times went from 3.15 weeks to 3.28 weeks; cold rolled actually declined from 4.97 weeks to 4.65 weeks; galvanized rose slightly from 5.14 weeks to 5.27 weeks and Galvalume moved out the most going from 5.83 weeks to 6.27 weeks. Compared to this time last year lead times – and these are weighted averages – are shorter on hot rolled and cold rolled with galvanized essentially the same and Galvalume slightly extended.

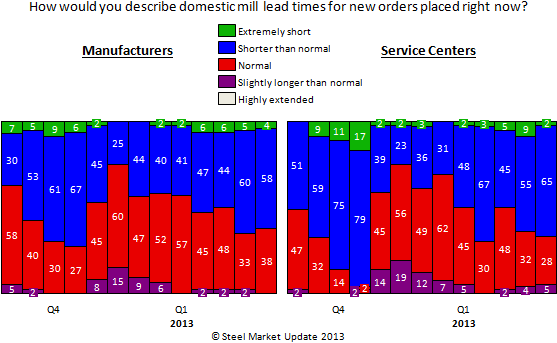

In order to provide a little better visual detail, SMU went back and took a look at our history regarding how the manufacturers and service centers viewed lead times as being “normal” or something other than normal. What you see in our graphic is both manufacturing companies and service centers are referencing lead times where “normal” is being pushed lower and the majority of buyers are reporting lead times as shorter than normal or extremely short. In this graphic you can clearly see the difference between early 4th Quarter 2012 when the mills were able to gather a small bump in prices to where we are in 1st Quarter which has not been able to gain any price traction to speak of.

Mill Negotiations

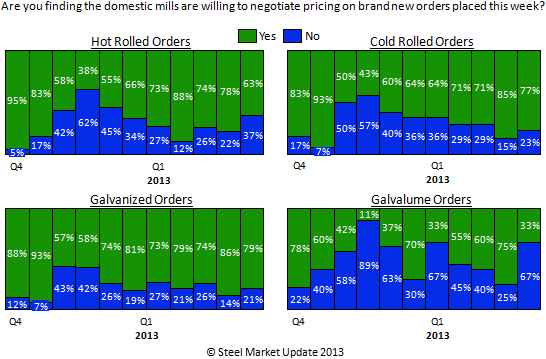

Usually, one week after a price increase announcement is made; you expect to see price flexibility in negotiations between the steel mills and their customers’ contract. The only area where we did see a large movement away from price flexibility was in Galvalume. All of the other items remained well over 60 percent with cold rolled and galvanized at 77 percent and 79 percent respectively.