Overseas

March 4, 2013

Europe Continues to Drag down Global PMI

Written by Sandy Williams

Written by: Sandy Williams

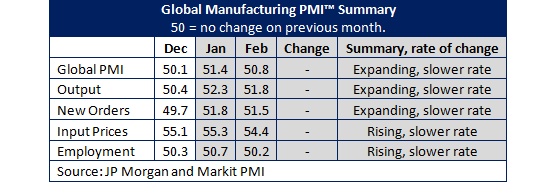

The JP Morgan Global Manufacturing PMI slipped to 50.8 from 51.4 in January indicating a slowing in manufacturing.

Global manufacturing output rose for the fourth month in a row with the U.S. leading the upward momentum. India, Mexico and Brazil also saw acceleration in production.

China showed slowing in February while Japan saw a modest decline. Europe continues to be weak with only marginal growth in Germany. Output fell in the UK and more severely in France, Greece and Italy. Aside from Germany, only Ireland, Netherlands and Russia reported growth in production.

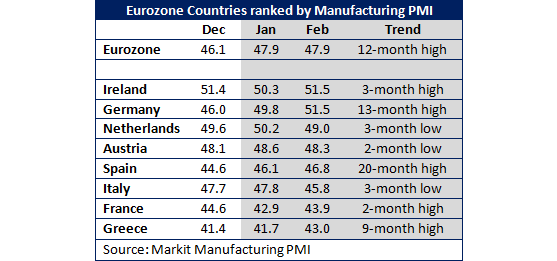

Eurozone

The Markit Eurozone Manufacturing PMI remained unchanged from last month at 47.9. Business conditions deteriorated for the nineteenth month but the rate of contraction appears to be slowing—a sign of hope for the region. The poor performance in the Eurozone manufacturing sector contributed to a fourth consecutive quarter drop in GDP. Germany and Ireland are the only two countries to stay above the 50 mark in February. France, Spain and Italy continue to be well below the indicator for growth.

China

Adjusting for the Chinese holiday season, the HSBC China Manufacturing PMI dropped to 50.4 from 52.3 in January. The drop came as a surprise to some analysts, falling short of expectations. The official China PMI also registered a drop, slipping to 50.1 from 50.4 in January. HSBC reported that output expanded for the fourth month but only marginally. New orders and new export orders saw slight increases, with export growth due to increased demand from Europe, Japan and the U.S. Delivery times shortened for the first time since September possibly due to fewer orders from vendors. Overall, China continues to be in recovery, albeit mild, staying above the 50 mark for four successive months

Japan

Output and new orders continued to fall in Japan while the depreciation of the yen increased operating costs. The Markit/JMMA Japan Manufacturing PMI remained below the 50 mark for the ninth month but rose to its highest level since June, registering 48.5. In comparison, the January reading was 47.7. Demand was down domestically and abroad. New export orders continued to decline in February continuing an 11 month trend. The manufacturing sector is expected to have a quarter decline of -1.0 percent for the first quarter of 2013.

Vietnam

Vietnam continued to report weak demand as production and new orders fell in February. The HSBC Vietnam Manufacturing PMI dropped from 50.1 in January to 48.3 in February indicating contraction in operating conditions. Excess capacity and backlogs persisted in February and jobs losses occurred for the first time in five months. Raw materials prices were higher, including metals, causing manufactures to increase selling prices. Although analysts suggest the worst is over for Japan, the recovery process continues to be uneven.

Russia

Growth in new orders slowed slightly in the shortened month of February. Domestic demand, however, continues to be strong, extending its growth trend to 17 months. The HSBC Russia PMI registered at 52.0 in February, unchanged from January and has been above the 50 mark in 16 of the last 17 months. Export orders continue to languish as they have since the second half of last year. Labor and inventory were both reduced in February. Customers saw lower prices as manufacturing costs eased.

Brazil

The HSBC Brazil PMI dropped slightly to 52.5 in February, down from a 22-month high of 53.2. Brazil has been above the 50 mark, signaling expansion, for five consecutive months. Output increased as demand picked up domestically. New export orders rose for the third straight month and were attributed to improvement in global market conditions. Raw materials, including steel, were higher in February and costs were passed on to customers in finished products. The increase in key components of the Index suggest that manufacturing activity is stronger than the first quarter of 2013 as compared to the second semester of 2012 and a signal of modest economic recovery.

Mexico

Mexico’s rate of growth slowed significantly in February to an HSBC PMI of 53.4 from 55 in January. Output and new orders increased during the month, but at weaker rates. An increase in new orders was accompanied by a strong rise in quantity of inputs bought by manufacturers. Input price inflation rose to its highest rate in eight months. Analysts suggest that due to a decreased PMI for the last two months, a loss of momentum will prevail in the first quarter of 2013. A healthy GDP growth of 3.2 percent is forecast for the year.

Canada

The RBC Canadian Manufacturing PMI indicates a modest improvement in Canada’s manufacturing sector, moving to 51.7 in February from 50.5 in January and its highest level since September 2012. Output and new orders increased as demand improved. Job creation was a four month high in February. Delivery times lengthened in February due to heavy snow falls. The rate of cost inflation was modest and slowed to a seven-month low with price increases seen in metals, chemicals, and resins. Exports picked up to the U.S., Japan and China. Analysts for RBC said that the business outlook was optimistic but growth still remains “below par.”

The Manufacturing Purchasing Managers’ Index is a composite indicator designed to provide an overall view of activity in the manufacturing sector and acts as a leading indicator for the whole economy. The indicator is derived from individual diffusion indices which measure changes in output, new orders, employment, suppliers’ delivery times and stocks of goods purchased. A reading of the PMI below 50.0 indicates that the manufacturing economy is generally declining; above 50.0, that it is generally expanding. A reading of 50.0 signals no change.