Product

March 1, 2013

Chicago PMI

Written by John Packard

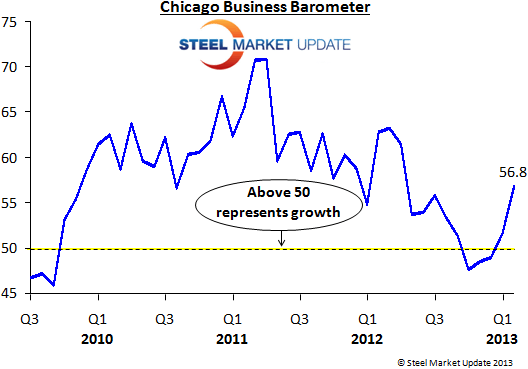

The Chicago Purchasing Managers reported the Chicago Business Barometer rose again, up 1.2 points to 56.8, its highest level since last March. There was improvement in New Orders, Order Backlogs, and Supplier Deliveries while Production and Employment expanded at a slower pace. New orders reported its third consecutive monthly gain and 11-month high while order backlogs had its fourth increase in five months. Inventories slowed down a bit from January’s high while employment continued to expand but at a slower pace than the previous month. Supplier deliveries had virtually no change while prices paid rose slightly. Capital equipment lead times shortened while M.R.O. supplies lead time lengthened slightly. (Source: Institute of Supply Management)

The Chicago Purchasing Managers reported the Chicago Business Barometer rose again, up 1.2 points to 56.8, its highest level since last March. There was improvement in New Orders, Order Backlogs, and Supplier Deliveries while Production and Employment expanded at a slower pace. New orders reported its third consecutive monthly gain and 11-month high while order backlogs had its fourth increase in five months. Inventories slowed down a bit from January’s high while employment continued to expand but at a slower pace than the previous month. Supplier deliveries had virtually no change while prices paid rose slightly. Capital equipment lead times shortened while M.R.O. supplies lead time lengthened slightly. (Source: Institute of Supply Management)