Product

February 27, 2013

SMU Price Ranges & Indices: Prices Slip & Slide

Written by John Packard

Frustration appears to be running high as buyers and sellers try to hold on to the gains (or to the floor) made a few weeks ago.

Despite their order books being weak, domestic mills do not seem willing to go below (or in many cases match) their previous deal. However, if they are not willing to move it seems many companies are not willing to buy. Inventories are imbalanced and service centers/distributors are selling like they are desperate to generate orders. In fact, most mill “deals” over the last 60-days have just been passed along to the end user which has only lead to margin compression and decreased value to existing inventories. In such a large and powerful industry one would expect steel mills to control pricing, but instead the market is currently being driven by the lowest common denominator. Until lead-times extend we should not expect the mills to have any control over the equation.

The loss of control appears to have affected spot market pricing this week and may explain why U.S. Steel made their price increase announcement earlier this afternoon. Steel prices have gone from slowly drifting to slipping and sliding lower. Here is how Steel Market Update saw prices this week:

The trend for hot rolled remains stuck in a very weak Neutral even as prices slip and slide lower. The attempt by U.S. Steel today may stop the slide but we will not know for sure for a few weeks as we wait for the other mills and the buyers to react to USS action.

Here is how we see spot prices this week:

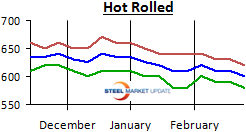

Hot Rolled Coil: SMU Range is $580-$620 per ton ($29.00/cwt-$31.00/cwt) with an average of $600 per ton ($30.00/cwt), fob mill, east of the Rockies. Both the lower and upper ends of our range dropped by $10 per ton when compared to one week ago. Our average is now $10 per ton less than one week ago. The trend for hot rolled remains stuck in a very weak Neutral even as prices slip and slide lower. The attempt by U.S. Steel today may stop the slide but we will not know for sure for a few weeks as we wait for the other mills and the buyers to react to USS action.

Hot Rolled Coil: SMU Range is $580-$620 per ton ($29.00/cwt-$31.00/cwt) with an average of $600 per ton ($30.00/cwt), fob mill, east of the Rockies. Both the lower and upper ends of our range dropped by $10 per ton when compared to one week ago. Our average is now $10 per ton less than one week ago. The trend for hot rolled remains stuck in a very weak Neutral even as prices slip and slide lower. The attempt by U.S. Steel today may stop the slide but we will not know for sure for a few weeks as we wait for the other mills and the buyers to react to USS action.

Hot Rolled Lead Times: 2-5 weeks.

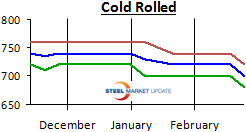

Cold Rolled Coil: SMU Price Range is $680-$720 per ton ($34.00/cwt-$36.00/cwt) with an average of $700 per ton ($35.00/cwt) fob mill, east of the Rockies. The lower end of our range dropped by $20 per ton as did the upper end of our range when compared to one week ago. Our average is now $20 per ton less than one week ago. The trend for cold rolled remains stuck in a very weak Neutral even as prices slip and slide lower. The attempt by U.S. Steel today may stop the slide but we will not know for sure for a few weeks as we wait for the other mills and the buyers to react to USS action.

Cold Rolled Coil: SMU Price Range is $680-$720 per ton ($34.00/cwt-$36.00/cwt) with an average of $700 per ton ($35.00/cwt) fob mill, east of the Rockies. The lower end of our range dropped by $20 per ton as did the upper end of our range when compared to one week ago. Our average is now $20 per ton less than one week ago. The trend for cold rolled remains stuck in a very weak Neutral even as prices slip and slide lower. The attempt by U.S. Steel today may stop the slide but we will not know for sure for a few weeks as we wait for the other mills and the buyers to react to USS action.

Cold Rolled Lead Times: 4-7 weeks.

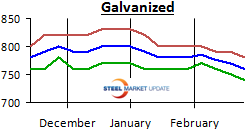

Galvanized Coil: SMU Base Price Range is $34.00/cwt-$36.00/cwt with an average of $35.00/cwt plus applicable extras, fob mill, east of the Rockies. Both the lower and upper ends of our range dropped by $10 per ton when compared to one week ago. Our average is now $10 per ton less than one week ago. The trend for galvanized remains stuck in a very weak Neutral even as prices slip and slide lower. The attempt by U.S. Steel today may stop the slide but we will not know for sure for a few weeks as we wait for the other mills and the buyers to react to USS action.

Galvanized Coil: SMU Base Price Range is $34.00/cwt-$36.00/cwt with an average of $35.00/cwt plus applicable extras, fob mill, east of the Rockies. Both the lower and upper ends of our range dropped by $10 per ton when compared to one week ago. Our average is now $10 per ton less than one week ago. The trend for galvanized remains stuck in a very weak Neutral even as prices slip and slide lower. The attempt by U.S. Steel today may stop the slide but we will not know for sure for a few weeks as we wait for the other mills and the buyers to react to USS action.

Galvanized .060” G90 Benchmark: SMU Range is $740-$780 per ton with an average of $760 per ton.

Galvanized Lead Times: 3-6 weeks.

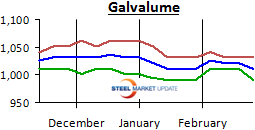

Galvalume Coil: SMU Base Price Range is $35.00/cwt-$37.00/cwt with an average of $36.00/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range dropped by $20 per ton while the upper end of our range remained intact when compared to one week ago. Our average is now $10 per ton less than one week ago. The trend for Galvalume remains stuck in a very weak Neutral even as prices slip and slide lower. The attempt by U.S. Steel today may stop the slide but we will not know for sure for a few weeks as we wait for the other mills and the buyers to react to USS action.

Galvalume Coil: SMU Base Price Range is $35.00/cwt-$37.00/cwt with an average of $36.00/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range dropped by $20 per ton while the upper end of our range remained intact when compared to one week ago. Our average is now $10 per ton less than one week ago. The trend for Galvalume remains stuck in a very weak Neutral even as prices slip and slide lower. The attempt by U.S. Steel today may stop the slide but we will not know for sure for a few weeks as we wait for the other mills and the buyers to react to USS action.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $991-$1031 per ton with an average of $1011 per ton.

Galvalume Lead Times: 5-8 weeks.