Product

February 25, 2013

SMU Survey Overview

Written by John Packard

Written by: John Packard, Publisher

An important piece of the value behind Steel Market Update is based on the relationships I developed during my 31 year tenure in the flat rolled steel business. Over that period of time I interacted with hundreds of companies in various capacities but primarily in a sales or management function. Many of those contacts have managed to make their way on to the Steel Market Update (SMU) steel market survey. Not all of them are members of Steel Market Update and we have introduced many new buyers and sellers of steel into the survey over the past five years who have met our qualifications for participation – active buyers or sellers of flat rolled steel in the North American market with knowledge of pricing, inventory and market trends within the industry.

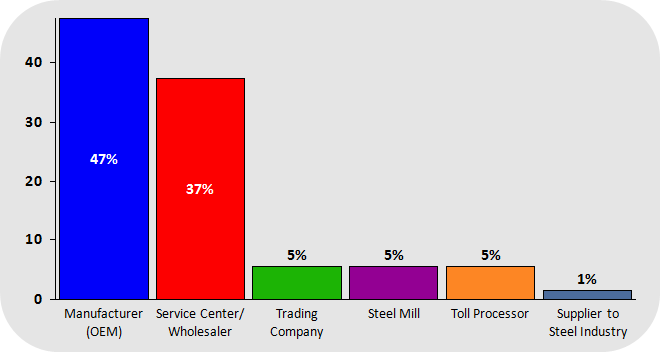

In our latest survey, SMU invited approximately 685 individuals representing well over 600 companies to participate in our survey. Of the companies who responded – 47 percent were manufacturing companies, 37 percent were service centers/wholesalers, 5 percent (each) were trading companies, steel mills and toll processors and 1 percent were suppliers to the industry (such as a paint or chemical company). We feel this is a fairly representative sample of the flat rolled industry.

In our latest survey, SMU invited approximately 685 individuals representing well over 600 companies to participate in our survey. Of the companies who responded – 47 percent were manufacturing companies, 37 percent were service centers/wholesalers, 5 percent (each) were trading companies, steel mills and toll processors and 1 percent were suppliers to the industry (such as a paint or chemical company). We feel this is a fairly representative sample of the flat rolled industry.

Our survey is produced twice per month. Based on the results of our questionnaire, we produce the results of our SMU Steel Buyers Sentiment Index which last week was measured at +22 and for the month was at +24.5 (after averaging the beginning of February +27 and last week’s +22).

Steel prices were relatively flat this past week with only galvanized registering any change (-$5 per ton).

We also produced articles on lead times and mill negotiations this past week which were produced out of our steel survey results. Our survey covers a whole host of trends – long term as well as those which are pertinent to a specific period of time (such as the reaction to a just announced price increase).

Where our survey excels is through our ability to provide a balanced market approach to the process by vetting a vast majority of our survey responders to insure they are able to provide quality responses and by our reasonably high response rate. SMU continues to add to and delete people from our survey on a monthly basis and we truly appreciate those who provide their time and energy so that we may better understand the steel market.