Product

February 25, 2013

SMU Comparison Price Indices: Another Week of “Going Nowhere in the Hurry Blues”

Written by John Packard

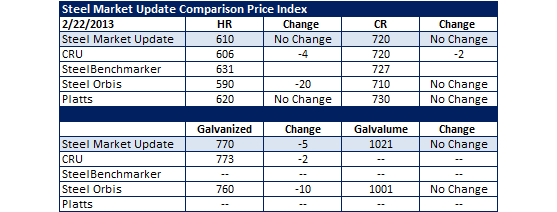

Steel Market Update (SMU) flat rolled price assessments remained the same on hot rolled, cold rolled and Galvalume this past week compared to the week before. Our galvanized price average was $5 per ton lower than one week earlier as the lower end of our range dropped by $10 per ton. Platts did not change their price assessments while the CRU noted slight weakness in their numbers dropping all three of the items (HR, CR and GI) slightly compared to the prior week. Steel Orbis was the first of the indices to drop their HRC number to under $600 per ton as they lowered their number by $20 per ton to $590 this past week. SteelBenchmarker did not produce new numbers this past week.