Product

February 22, 2013

SMU Steel Buyers Sentiment Index Finds Industry Slightly Less Optimistic

Written by John Packard

Steel Market Update (SMU) conducted our mid-February steel survey beginning on Monday and concluding on Thursday afternoon of this week. We invited approximately 685 active participants (buyers, sellers or executives) involved in the flat rolled steel segment of the industry to respond to our questions regarding market trends, pricing and Sentiment.

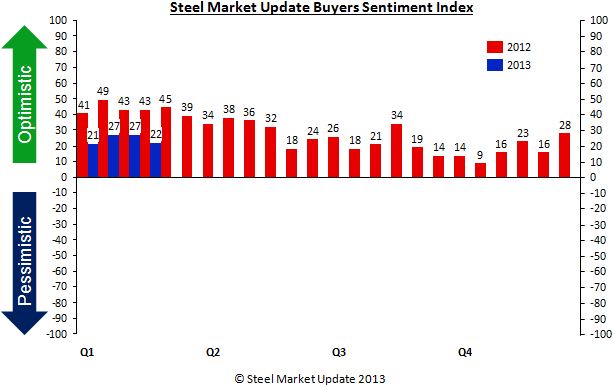

SMU Steel Buyers Sentiment Index was measured at +22 this week, down 5 points from the +27 we reported at the beginning of the month. Our Sentiment Index is finding the flat rolled steel community as being slightly less optimistic – but still in the optimistic range of our index. The monthly average is +24.5, a half point higher than the monthly average of January 2013.

SMU Steel Buyers Sentiment Index was measured at +22 this week, down 5 points from the +27 we reported at the beginning of the month. Our Sentiment Index is finding the flat rolled steel community as being slightly less optimistic – but still in the optimistic range of our index. The monthly average is +24.5, a half point higher than the monthly average of January 2013.

SMU Steel Buyers Sentiment Index is much less optimistic this year than last when February averaged +43 and January +45.

The responses collected during our survey process found steel buyers and sellers uneasy with the current market conditions:

January and February have shown an uptick in business activity, but the needs are primarily for short term release. There continues to be a hesitancy for any longer term commitments. Service Center

There is so much uneasiness in economy right now, and even with the DOW and NASDAQ hitting new highs, I feel there are too much hypothetical expectations being included in the run up. It only sets us up for a fall. A lot of decision makers are sitting on their hands waiting for someone to truly make the first move. Manufacturing Company who then went on to say:

We are seeing a serious slowdown in the awarding of work. There is a bunch of work being bid, but very little actually being awarded to anyone…a lot of fishing.

Not as good as I want but better than the media reports. Steel Mill

Conditions in the HVAC industry in our area continue to be challenged. We are not seeing any real improvement over the last couple of years. HVAC Wholesaler

Three Month Moving Average Shows Improving Trend in Sentiment

Over the past three months we have seen our Steel Buyers Sentiment Index relatively stable with December averaging +22, January +24 and February +24.5. The three month moving average (3MMA) is now +23.5, an improvement over the previous 3MMA of +21.83.

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from + 10 to + 100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently we send invitations to slightly less than 700 North American companies to participate in our survey. Our normal response rate is approximately 120-170 companies. Of those responding to this week’s survey 47 percent were manufacturing companies, 37 percent were service centers/distributors and the balance was made up of steel mills, trading companies and toll processors involved in the steel business.

Steel Market Update does canvass those being invited to participate in order to confirm their active participation in the flat rolled steel business. Our list is updated at least once per month and we are adding new companies on a continuous basis.