Product

February 22, 2013

Mill Lead Times Shorter - Affecting Negotiations

Written by John Packard

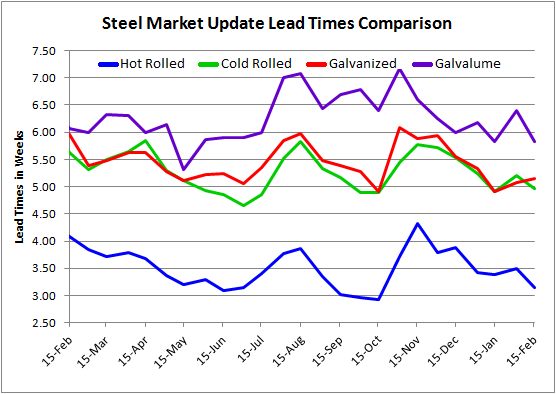

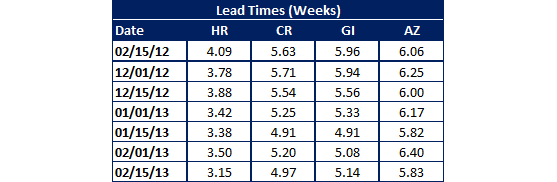

Based on the results of this week’s survey, lead times on hot rolled and cold rolled slid slightly compared to where they were at the beginning of the month. We found aluminized to have dropped by slightly more than half a week from 6.40 weeks down to 5.83 weeks while galvanized lead times actually increased slightly.

SMU lead times, which are weighted averages based on responses from manufacturers and service centers, are much shorter on hot rolled, cold rolled and galvanized compared to this time last year. Galvalume lead times are only slightly shorter than what we measured during the middle of February 2012 (also see graph at the end of this article).

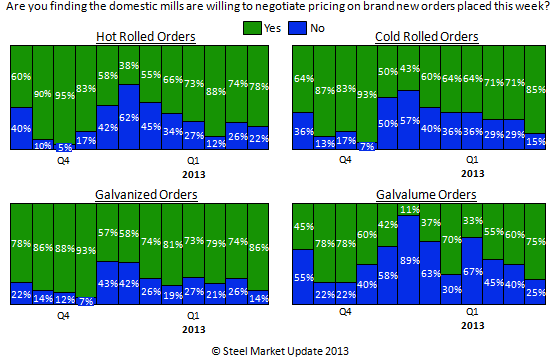

With the shortened lead times our survey found the domestic mills as willing to negotiate pricing on all four flat rolled products (see below).