Product

February 22, 2013

Hot Rolled Futures Consolidate Losses

Written by Bradley Clark

Written by: Bradley Clark, Director of Steel Trading, Kataman Metals

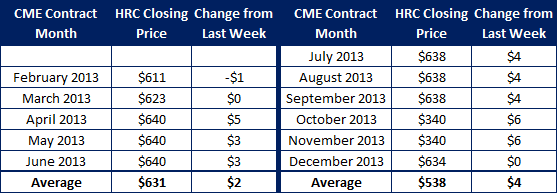

The physical HRC market continues to soften as mills offer steel at lower levels this week from a week before. The futures market has experienced a divergence in movements over the past week with the front of the curve weakening while the second half of the year is better bid. We see the Feb contract value at $610, March at $622 and April at $635 all down about $5 from last week. At the same time Q3 and Q4 periods have appreciated in value to $640 up about $5 from last week. This structural movement indicates a worsening sentiment for the coming couple of months but an optimism that the market will recover by the end of the year. We will see how this plays out, however sentiment feels pretty bearish out there at the moment.

Trades on the futures market this week have been spread out evenly down the curve. Q2 has traded between $635-640 and Q3 has traded up to $640 in decent volumes (over 10K tons).

Volumes have been quite robust again this week with over 20,000 tons trading. Open interest has increased a touch over the past few weeks as some traders have opened new positions.

Overall bearish sentiment still prevails in both the physical and futures markets. Some have written or speculated that another price hike is around the corner. In our view that would be a mistake on the mill’s part as the failure of the most recent price hike to take hold has really called into question the efficacy of these announcements without the fundamentals of the market supporting them. A small bump up in scrap prices due to weather issues may fuel some bullish sentiment in the next couple of weeks, but we most likely will only get back to January scrap levels at best, when HRC was transacting in the upper $500’s. Therefore, while a rally in prices would be welcomed by many in the market it feels like we are in store for a few more weeks if not months of weakness. Too many headwinds are still on the horizon for the steel industry.

Below is a table with yesterday’s HRC futures settlement prices on the CME contract for each individual month through Q2 2013 as of 2/20/2013 close:

OPEN INTEREST: 10,370 lots (1 lot = 20 short tons)