Product

February 22, 2013

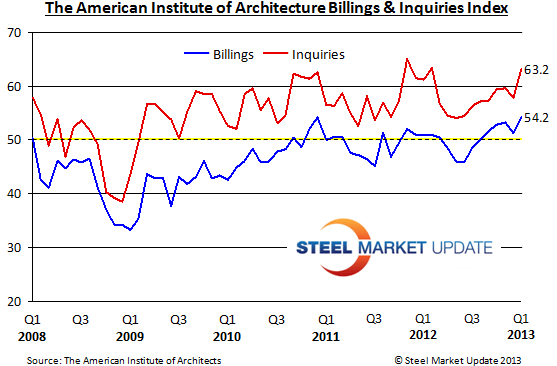

Architects Billing Index Above 50 for Six Consecutive Months

Written by Sandy Williams

Written by: Sandy Williams

The American Institute of Architects (AIA) released their Architects Billing Index (ABI) which is a leading economic indicator of construction activity. The Architecture Billings Index rose in January to54.2, up from a seasonally adjusted 51.2 in December and the strongest growth since November 2007.

The ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The score reflects an increase in demand for design services with any score above 50 indicating an increase in billing. In January, the AIA seasonally adjusts factors used to calculate the ABI, resulting in a revision of recent ABI values.

The ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The score reflects an increase in demand for design services with any score above 50 indicating an increase in billing. In January, the AIA seasonally adjusts factors used to calculate the ABI, resulting in a revision of recent ABI values.

Interest in building continues to accelerate with the new projects inquiry index surging to 63.2 from a seasonally adjusted 57.9 in December.

“We have been pointing in this direction for the last several months, but this is the strongest indication that there will be an upturn in construction activity in the coming months,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “But as we continue to hear about overall improving economic conditions and that there are more inquiries for new design projects in the marketplace, a continued reservation by lending institutions to supply financing for construction projects is preventing a more widespread recovery in the industry.”

All the regions and sectors reported positive business conditions in January. Regionally, the West had the most improvement at 53.4, moving above the 50 mark in January. The Midwest score was 54.4, the South was 51.7 and the Northeast posted a score of 50.3

The sector index breakdown was as follows: mixed practice (54.9), multi-family residential (54.5), commercial/industrial (52.0) and institutional (50.2).