Product

February 18, 2013

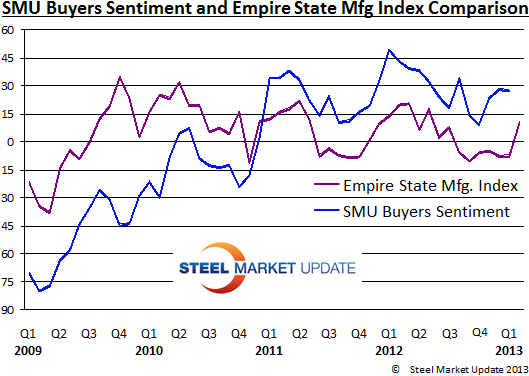

Empire State Manufacturing Business Conditions Positive for 1st Time Since July

Written by Sandy Williams

Written by: Sandy Williams

After six months of decline, the Empire State Manufacturing Survey business conditions index rose into positive territory in February. The index climbed 18 points to register 10—the highest level since July 2012.

New orders picked up, rising 20 points to 13.3—the highest level since summer 2011. Shipments increased sixteen points to 13.1. Delivery times lengthened slightly, moving up four points to 2.0. Inventories rose nine points to settle at zero after declining in recent months. Prices paid continued to climb in February, increasing 2.5 points while prices paid dropped 2.1 points but stayed in positive territory. The employee index rose into positive numbers indicating an improving labor market.

New orders picked up, rising 20 points to 13.3—the highest level since summer 2011. Shipments increased sixteen points to 13.1. Delivery times lengthened slightly, moving up four points to 2.0. Inventories rose nine points to settle at zero after declining in recent months. Prices paid continued to climb in February, increasing 2.5 points while prices paid dropped 2.1 points but stayed in positive territory. The employee index rose into positive numbers indicating an improving labor market.

Manufacturers are optimistic about the outlook for the next six months. The future business conditions index rose 11 points to 33.1. Future orders and shipments indices continue to rise but at slower paces. Future prices paid index rose while the future prices received continued to drop. More investment is on the horizon with capital expenditures and technology spending indices both climbing in the outlook for the next six months.

The Empire State Manufacturing Survey is conducted monthly by the Federal Reserve Bank of New York. A pool of approximately 200 manufacturing executives, typically the president or CEO from a variety of industries in New York State, respond to a questionnaire about operating conditions and report the change in a variety of indicators from the previous month and the likely direction of those same indicators six months ahead. About 100 responses are received with the survey’s main index on general business conditions determined by a distinct question, not a weighted average of other indicators. The data is seasonally adjusted.