Product

February 15, 2013

HRC Futures Breaks the Hearts of the Bulls as Prices Experience a Break ‘down’

Written by Bradley Clark

Written by: Brad Clark, Director of Steel Trading, Kataman Metals

It appears that the market finally capitulated this week with the physical market taking a turn south as recent price hikes seem to have failed. After a couple of weeks with consumers, distributors, producers of coils eyeing each other up to see who will blink first it seems the consumers win this round. Too much inventory carried over from the recent nadir in prices last October to a continued weakening of end user demand have contributed to the resumption of prices sliding.

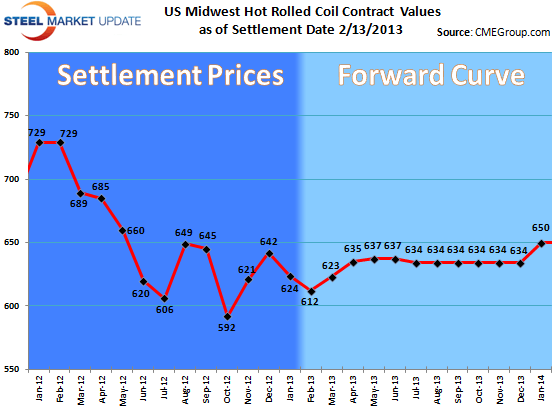

The futures market, taking its cue from the physical market, took another leg down this week on the front month contracts. February has been offered at 615 in depth this week, March has traded at $620 and April down to $636. These prices are all down $5-15 from last weeks traded prices and indicate a turn in sentiment from steady to bullish to decidedly bearish.

Volumes have been quite robust this week with over 30,000 tons trading, mostly on nearby months. Open interest has decreased a touch over the past few weeks as some traders have closed out positions.

A bearish sentiment is beginning to take hold on Feb-April periods as offers are more prevalent that bid, however, bids are fairly solid for May-Q4 positions indicating some in the market are holding out hope that a rally is still in the cards as we head into the summer. Potential drivers of a rally to keep a look out for are for increased end user demand in construction, TK sale to a domestic mill or a strong spike in raw material costs. What seems most certain is that volatility and uncertainty intend to remain in the steel market.

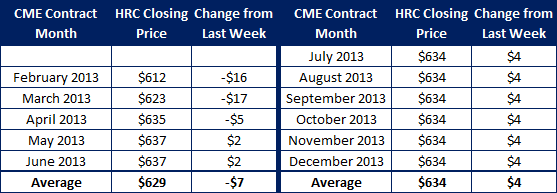

Below is a table with yesterday’s HRC futures settlement prices on the CME contract for each individual month through Q2 2013 as of 2/13/2013 close:

OPEN INTEREST: 8,937 lots (1 lot = 20 short tons)