Product

February 13, 2013

Steel Exports Continued to Decline in December

Written by John Packard

Falls Church, VA, February 12, 2013 – Steel exports continued to fall in December, declining another 2.9 percent compared to November after declining nearly 16 percent in November compared to October, according to government data. “Steel exports softened at the end of 2012 due to economic uncertainty in many international markets, very much mirroring the experience in the US market. The decline in exports in December 2012 compared to December 2011 was 19.3 percent and reflected declines in both our close NAFTA partners’ markets as well as smaller markets for US-made steel. The slow finish to 2012 and slow start of 2013 in the US and international markets has clearly impacted international demand even in faster-growing developing countries,” said David Phelps, president AIIS.

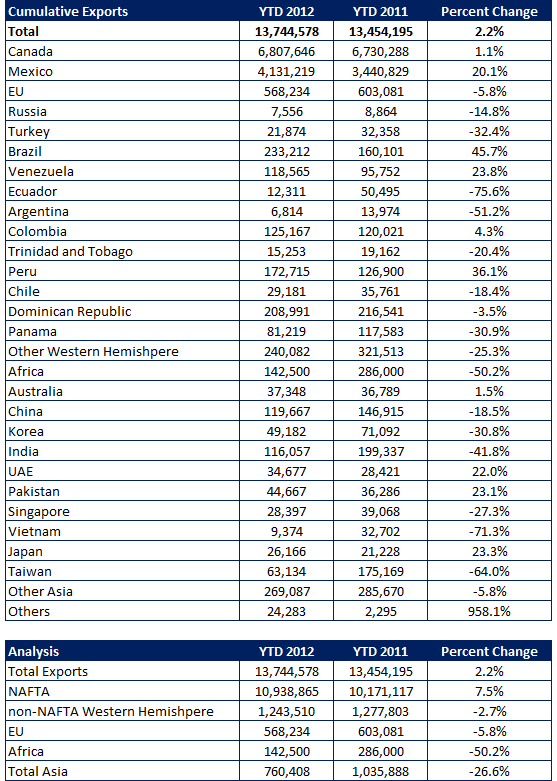

For the full year of 2012 compared to 2011, exports reached 13.7 million tons, an increase of 2.2 percent. “Steel exports set a new record in 2012, increasing 2.2 percent over the previous record year of 2008. The weaker conditions at the end of 2012 showed up in the year-to-year comparisons 2012 versus 2011, with the growing Mexican market posting the best results, increasing nearly 700,000 tons. While setting a new record for exports of US-made steel is gratifying, the slump at the end of the year is cause for concern at least about early 2013 export business opportunities. The signs that some pundits see for improved conditions later in 2013 first quarter give some reason for (very) cautious optimism at this point however,” concluded Phelps.

Total Steel exports in December 2012 were 968.990 thousand tons compared to 998.022 thousand tons in November 2012, a 2.9 percent decrease, and a 19.3 percent decrease compared to December 2011. For the year-to-date period, total exports increased from 13.454 million tons in 2011 to 13.745 million tons in 2012 period, a 2.2 percent increase. (Source: AIIS Press Release – Including Tables Below)