Product

February 11, 2013

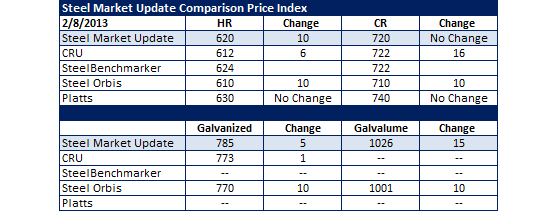

SMU Comparison Price indices: Everyone Creeping Prices Up

Written by John Packard

Prices crept up on most of the indexes watched by Steel Market Update on a regular basis – even the straggler, Steel Orbis, raised their indices last week. CRU and Steel Orbis are at the low end of the range for Benchmark hot rolled with SMU and SteelBenchmarker somewhere in the middle and Platts at the high end of the range. SteelBenchmarker did not produce new numbers this past week (they only publish prices twice per month).

The various indices are confirming what our SMU steel market survey has also been gathering regarding market intelligence this past week. The domestic steel mills raised prices $40-$50 per ton the week of January 21st. Our survey respondents suggest that a portion of the increase is being collected by the domestic industry and our index and the other indices suggest that is indeed what is happening. Of those responding to our survey 70 percent reported “some” of the increase was attempted at being collected by the domestic steel mills. Only 18 percent reported mills attempting to collect all of the increases and the smallest portion – 12 percent – told us none of the increase was being attempted to be collected.

The various indices are confirming what our SMU steel market survey has also been gathering regarding market intelligence this past week. The domestic steel mills raised prices $40-$50 per ton the week of January 21st. Our survey respondents suggest that a portion of the increase is being collected by the domestic industry and our index and the other indices suggest that is indeed what is happening. Of those responding to our survey 70 percent reported “some” of the increase was attempted at being collected by the domestic steel mills. Only 18 percent reported mills attempting to collect all of the increases and the smallest portion – 12 percent – told us none of the increase was being attempted to be collected.