Product

February 8, 2013

Mill Lead Times Extend Slightly – Mill Negotiations Continue

Written by John Packard

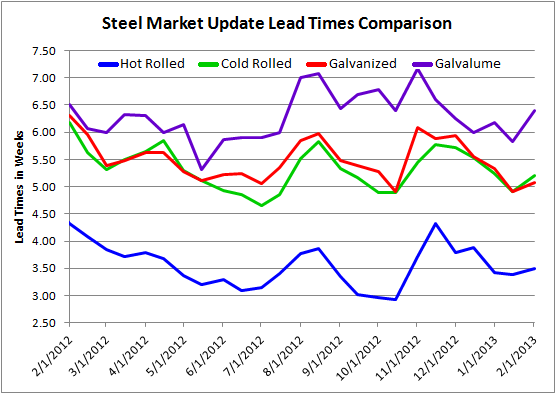

Based on the results of this week’s SMU steel market survey, lead times have moved out slightly at the domestic steel mills compared to where they were during the middle of January. We are now seeing hot rolled lead times averaging 3.5 weeks, cold rolled and galvanized at just over 5 weeks and Galvalume at almost 6.5 weeks. With the exception of Galvalume – HR, CR and GI are still well behind where their lead times were at this time last year (see table below and graph at the end of this article).

Even with the domestic mills having hiked prices by $40 to $50 per ton over the past few weeks their sales people continue to negotiate pricing with their customers – according to the results from our survey which concluded this afternoon. The only item where we found any significant drop was hot rolled – from 88 percent to 74 percent – in other words during the middle of January 88 percent of those responding to our survey reported the domestic mills are willing to negotiate hot rolled pricing. This week that number has dropped to 74 percent. As you can see by the graphic below – all of the other flat rolled items continue to have a significant amount of “discussion” associated with the placement of any new orders.