Product

February 6, 2013

SMU Price Ranges & Indices: Some Modest Gains Made

Written by John Packard

The bottom end of our range exhibited some “tightening” over the past week – although not as much as one might expect in light of the size of the price increase announcements made by the domestic mills. Based on survey results the bottom end of the range for our benchmark hot rolled coil is no longer below $600 per ton. In fact, with the exception of cold rolled, each of the products we provide price assessments has seen the bottom end of their range rise modestly over the past week and, in some cases, we have also captured a very modest increase in the upper end of our range as well.

Here is how we see spot prices this week:

Hot Rolled Coil: SMU Range is $600-$640 per ton ($30.00/cwt-$32.00/cwt) with an average of $620 per ton ($31.00/cwt), fob mill, east of the Rockies. The lower end of our range improved by $20 per ton compared to where it was this time last week. The upper end of our range remained intact while our average rose by $10 per ton. The trend for hot rolled continues to be neutral as we watch how the market will react to scrap prices dropping while the domestic mills push for higher prices.

Hot Rolled Coil: SMU Range is $600-$640 per ton ($30.00/cwt-$32.00/cwt) with an average of $620 per ton ($31.00/cwt), fob mill, east of the Rockies. The lower end of our range improved by $20 per ton compared to where it was this time last week. The upper end of our range remained intact while our average rose by $10 per ton. The trend for hot rolled continues to be neutral as we watch how the market will react to scrap prices dropping while the domestic mills push for higher prices.

Hot Rolled Lead Times: 2-5 weeks.

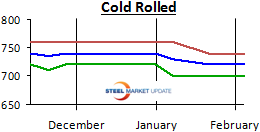

Cold Rolled Coil: SMU Price Range is $700-$740 per ton ($35.00/cwt-$37.00/cwt) with an average of $720 per ton ($36.00/cwt) fob mill, east of the Rockies. Both the lower and upper end of our range remained the same as one week ago. Our average also remained the same as it was one week earlier. The trend for CR is neutral as we watch how the market will react to the decline in scrap prices while the domestic mills push for higher steel prices.

Cold Rolled Coil: SMU Price Range is $700-$740 per ton ($35.00/cwt-$37.00/cwt) with an average of $720 per ton ($36.00/cwt) fob mill, east of the Rockies. Both the lower and upper end of our range remained the same as one week ago. Our average also remained the same as it was one week earlier. The trend for CR is neutral as we watch how the market will react to the decline in scrap prices while the domestic mills push for higher steel prices.

Cold Rolled Lead Times: 4-7 weeks.

Galvanized Coil: SMU Base Price Range is $35.50/cwt-$37.00/cwt with an average of $36.25/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range improved (rose) by $10 per ton compared to one week ago. The upper end of our range remained the same as this time last week. Our average has adjusted higher by $5 per ton ($.25/cwt) compared to one week ago. The trend for galvanized continues to be neutral as we watch to see how the market will react to the decline in scrap prices, watch mill lead times and production, and see if the domestic mills are able to collect more of the announced price increases in the days ahead.

Galvanized Coil: SMU Base Price Range is $35.50/cwt-$37.00/cwt with an average of $36.25/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range improved (rose) by $10 per ton compared to one week ago. The upper end of our range remained the same as this time last week. Our average has adjusted higher by $5 per ton ($.25/cwt) compared to one week ago. The trend for galvanized continues to be neutral as we watch to see how the market will react to the decline in scrap prices, watch mill lead times and production, and see if the domestic mills are able to collect more of the announced price increases in the days ahead.

Galvanized .060” G90 Benchmark: SMU Range is $770-$800 per ton with an average of $785 per ton.

Galvanized Lead Times: 3-6 weeks.

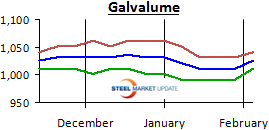

Galvalume Coil: SMU Base Price Range is $36.00/cwt-$37.50/cwt with an average of $36.75/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range rose by $20 per ton compared to where we were one week ago. The upper end of our range improved by $10 per ton during the same time period. The trend for Galvalume is neutral (same as galvanized above) pending the market’s reaction to scrap, lead times and the ability of the domestic mills to collect more of the announced price increases from here.

Galvalume Coil: SMU Base Price Range is $36.00/cwt-$37.50/cwt with an average of $36.75/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range rose by $20 per ton compared to where we were one week ago. The upper end of our range improved by $10 per ton during the same time period. The trend for Galvalume is neutral (same as galvanized above) pending the market’s reaction to scrap, lead times and the ability of the domestic mills to collect more of the announced price increases from here.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1011-$1041 per ton with an average of $1026 per ton.

Galvalume Lead Times: 5-8 weeks.