Product

January 23, 2013

SMU Price Range & Indices: Hot Rolled Falters at Low End

Written by John Packard

As was reported over the past week, Steel Market Update found a number of buyers of varying sizes able to purchase hot rolled coil below $600 in the spot market. We did not find every mill or every region participating in the erosion of the bottom end of our range. What we found is the major concentration of buyers were in the $600-$630 range but we could not ignore the lower numbers – many of which were reported to expire today due to the AK Steel price announcement.

Here is how we are seeing the flat rolled market prices this week:

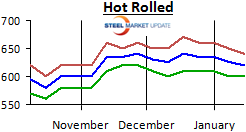

Hot Rolled Coil: SMU Range is $580-$640 per ton ($29.00/cwt-$32.00/cwt) with an average of $610 per ton ($30.50/cwt) fob mill, east of the Rockies. The lower end of our range moved lower by $20 per ton while the upper end of our range remained the same when compared to one week ago. Our average has adjusted lower by $10 per ton compared to one week ago. The trend for HR continues to be “Neutral” as we wait to see if other mills follow the AK Steel lead and announce price increases and then how.

Hot Rolled Coil: SMU Range is $580-$640 per ton ($29.00/cwt-$32.00/cwt) with an average of $610 per ton ($30.50/cwt) fob mill, east of the Rockies. The lower end of our range moved lower by $20 per ton while the upper end of our range remained the same when compared to one week ago. Our average has adjusted lower by $10 per ton compared to one week ago. The trend for HR continues to be “Neutral” as we wait to see if other mills follow the AK Steel lead and announce price increases and then how.

Hot Rolled Lead Times: 3-5 weeks

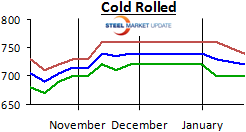

Cold Rolled Coil: SMU Range is $700-$740 per ton ($35.00/cwt-$37.00/cwt) with an average of $720 per ton ($36.00/cwt) fob mill, east of the Rockies. The lower end of our range remained intact while the upper end of our range moved lower by $10 per ton compared to one week ago. Our average adjusted lower by $5 per ton. The trend for CR is Neutral as the market waits to see if the other domestic mills will announce price increases and then will they be able to change momentum and move prices higher from here.

Cold Rolled Coil: SMU Range is $700-$740 per ton ($35.00/cwt-$37.00/cwt) with an average of $720 per ton ($36.00/cwt) fob mill, east of the Rockies. The lower end of our range remained intact while the upper end of our range moved lower by $10 per ton compared to one week ago. Our average adjusted lower by $5 per ton. The trend for CR is Neutral as the market waits to see if the other domestic mills will announce price increases and then will they be able to change momentum and move prices higher from here.

Cold Rolled Lead Times: 4-7 weeks

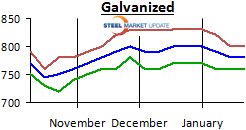

Galvanized Coil: SMU Base Price Range is $35.00/cwt-$37.00/cwt with an average of $36.00/cwt plus applicable extras, fob mill, east of the Rockies. Our galvanized prices have not changed over those from last week. The trend is Neutral for galvanized which, like hot rolled and cold rolled wait for the rest of the domestic mills to follow AK Steel’s lead.

Galvanized Coil: SMU Base Price Range is $35.00/cwt-$37.00/cwt with an average of $36.00/cwt plus applicable extras, fob mill, east of the Rockies. Our galvanized prices have not changed over those from last week. The trend is Neutral for galvanized which, like hot rolled and cold rolled wait for the rest of the domestic mills to follow AK Steel’s lead.

Galvanized .060” G90 Benchmark: SMU Range is $760-$800 with an average of $780 per ton.

Galvanized Lead Times: 4-7 weeks

Galvalume Coil: SMU Base Price Range is $35.00/cwt-$37.00/cwt with an average of $36.00/cwt plus applicable extras, fob mill, east of the Rockies. Our Galvalume prices have not changed over those from last week. The trend is Neutral for Galvalume as we wait for the rest of the domestic steel industry to follow AK Steel and announce price increases.

Galvalume Coil: SMU Base Price Range is $35.00/cwt-$37.00/cwt with an average of $36.00/cwt plus applicable extras, fob mill, east of the Rockies. Our Galvalume prices have not changed over those from last week. The trend is Neutral for Galvalume as we wait for the rest of the domestic steel industry to follow AK Steel and announce price increases.

Galvalume .0142” AZ50 Grade 80 Benchmark: SMU Range is $991-$1031 per ton with an average of $1011 per ton.

Galvalume Lead Times: 4-7 weeks.