Product

January 23, 2013

Existing Home Sales Slip Slightly in December but Rise for the Year

Written by Sandy Williams

Existing home sales slowed slightly in December but limited inventory is fueling price increases, according to the National Association of Realtors. December sales declined 1.0 percent to a seasonally adjusted annual rate of 4.94 million in December from a downwardly revised 4.99 million in November, but are 12.8 percent above the 4.38 million-unit level in December 2011.

Existing home sales slowed slightly in December but limited inventory is fueling price increases, according to the National Association of Realtors. December sales declined 1.0 percent to a seasonally adjusted annual rate of 4.94 million in December from a downwardly revised 4.99 million in November, but are 12.8 percent above the 4.38 million-unit level in December 2011.

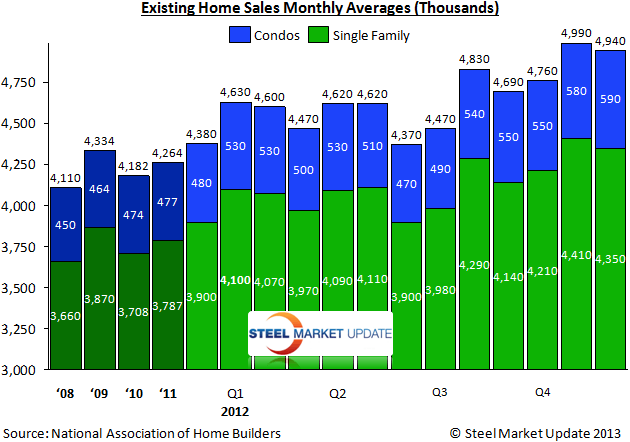

The preliminary annual total for existing home sales in 2012 was 4.65 million, up 9.2 percent from 4.26 million in 2011 and at the highest level in five years.

The preliminary annual total for existing home sales in 2012 was 4.65 million, up 9.2 percent from 4.26 million in 2011 and at the highest level in five years.

Housing inventory fell 8.6 percent to 1.82 million existing homes for sale—a housing supply of 4.4 months at the current sales pace and the lowest supply since May of 2005.

The median price for existing homes in December was 11.5 percent above the December 2011 price. Foreclosures and short sales accounted for about 24 percent of December sales, down from 32 percent in December2011.

Existing single-family home sales were down 1.4 percent in December to a seasonally adjusted annual rate of 4.35 million but were 11.5 percent above December 2011 levels. Existing condo sales rose 1.7 percent in December and were up 16 percent from a year ago.

Regionally, Northeast and West annual levels of existing home sales increased in December by 3.2 percent and 5.1 percent, and year over year by 10.3 percent and 8.8 percent, respectively. Annual Midwest sales fell 5.9 percent in December but were 15.5 percent higher year-over-year. Sales in the South declined 3 percent in December but were up 14.7 percent from December 2011.

Lawrence Yun, NAR chief economist, said pent-up demand is sustaining the market. “Record low mortgage interest rates clearly are helping many home buyers, but tight inventory and restrictive mortgage underwriting standards are limiting sales,” he said. “The number of potential buyers who stayed on the sidelines accumulated during the recession, but they started entering the market early last year as their financial ability and confidence steadily grew, along with home prices. Likely job creation and household formation will continue to fuel that growth. Both sales and prices will again be higher in 2013.”