Product

January 21, 2013

Mill Lead Times Shrink & Negotiations Expand This Past Week

Written by John Packard

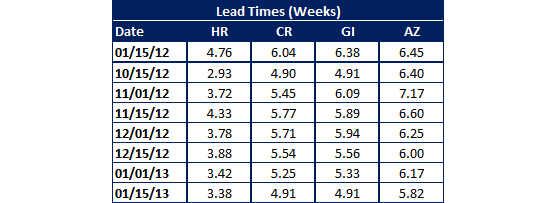

Based on the weighted results from our most recent steel survey which was conducted this past week, SMU found lead times slipping slightly on all flat rolled products followed by our company. Benchmark hot rolled average lead times declined to 3.38 weeks and are much shorter than the 4.76 weeks measured by the SMU survey during the middle of January one year ago. We found similar situations with cold rolled, galvanized and Galvalume – all of which have shorter lead times than the prior week as well as one year ago.

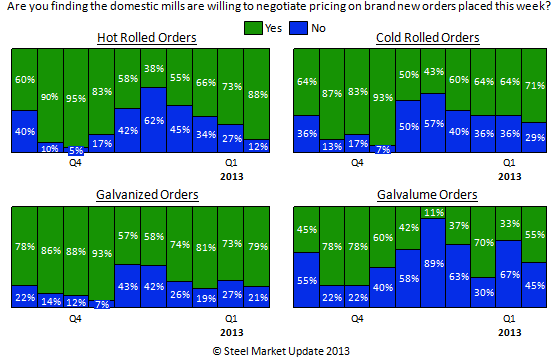

The net result of the shorter lead times is shown in our negotiation comparison graph – again, based on the results of this past week’s survey our respondents advised SMU that the domestic mills were more willing to negotiate hot rolled, cold rolled, galvanized and Galvalume pricing this past week than they were during the first week of January.