Product

January 18, 2013

U.S. Service Centers Show Growth in 2012 – Canadians Not So Much

Written by John Packard

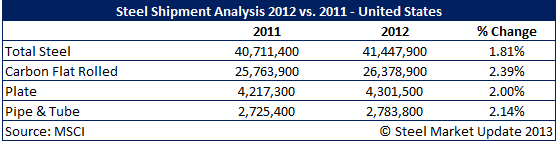

U.S. distributors grew annual shipments by 1.81 percent (all products) according to Metal Service Center Institute data during calendar year 2012. Shipments totaled 41,447,900 tons.

Flat rolled shipments also rose during 2012 totaling 26,378,900 tons which represents an improvement of 2.39 percent over the previous year. Plate shipments were up by 2 percent, while pipe and tube rose by 2.14 percent.

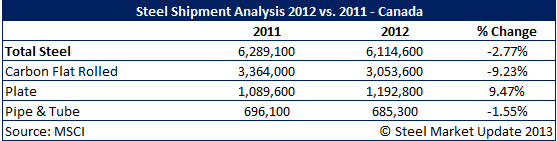

Canadian Service Center Shipments Decline on all but Plate

Canadian distributors did not fare as well as their southern counterparts as total steel shipments declined from 6,289,100 tons in 2011 to 6,114,600 tons (-2.77 percent) during 2012.

Carbon flat rolled led the decline slipping by 9.23 percent to 3,053,600 tons. Pipe and tube slid 1.55 percent to 685,300 tons. Plate did show a sizeable improvement rising by 9.47 percent to 1,192,800 tons from 1,089,600.