Product

January 18, 2013

U.S. Service Centers Produce Disappointing Shipping & Inventory Data for December

Written by John Packard

The Metal Service Center Institute (MSCI) released service center shipment and inventory data for the month of December on Wednesday of this week. For total steel products, shipments were down slightly to 136,900 tons per day compared to 140,800 tons per day last year. On a seasonally adjusted basis shipments were 4.6 percent lower than one year ago (all products).

Total steel inventories stood at 8,548,500 tons, up 377,000 tons compared to the previous month and up 2.4 percent year-over-year. Months of inventory stood at 3.1 (unadjusted), an increase of .5 for the month. Seasonally adjusted inventory was 2.5 and the same level as the prior month. According to Bank of America Merrill Lynch Research steel analyst Timna Tanners, December inventories were 16 percent below the historical average but were 16 percent above the more recent 3-year average.

Carbon Flat Rolled

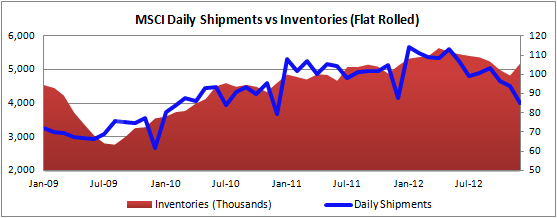

The swoon in the sputtering U.S. flat rolled market continued during the month of December, according to the MSCI data. Going back to October, U.S. service centers have failed each and every month to beat the daily shipment rate of the prior year. In December, the U.S. service centers averaged 85,100 tons per day in flat rolled shipments. This is the lowest daily shipping rate since December 2010. The 85,100 T/Day rate is 7.5 percent lower than 87,600 tons per day shipped one year ago. On a seasonally adjusted basis shipments were down 5.7 percent in December 2012 vs. 2011.

Flat rolled inventories stood at 5,181,000 tons which is 355,200 tons more than the previous month. U.S. service centers had 3.0 months of inventory on their floors, up from 2.4 months from the previous month (unadjusted) or, on a seasonally adjusted basis, inventories increased from 2.3 to 2.4 months.

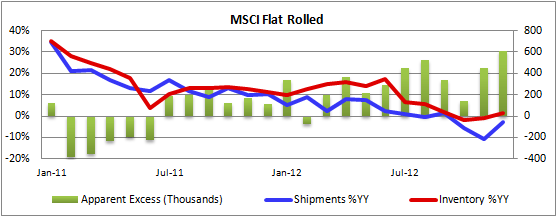

Apparent Excess Jumps to 608,000 Tons

Inventory excess grew during the month of December, according to the SMU Apparent Excess model which was part of our purchase of the assets of Steel Reality.

Plate

Plate shipments totaled 287,600 tons for a daily shipping rate of 14,400 tons, down from November’s 14,500 ton per day rate and well below 2011 December rate of 14,900 tons per day. On a seasonally adjusted basis shipments were 2.9 percent lower in 2012 than 2011.

Inventories of plate finished the month at 1,043,100 tons slightly higher than the prior month and 4.7 percent higher than the previous year. At the end of December, U.S. service centers had 3.6 months of inventory (+0.3 months) on a unadjusted basis and 3.0 months (no change) on a seasonally adjusted basis.

Pipe & Tube

U.S. distributors shipped 197,700 tons of pipe and tube, or 9,900 tons per day during the month of December. This shipping rate was lower than the 10,200 tons per day shipped during the month of November. The total tons were down from the prior year but 4.4 percent on an unadjusted basis but were almost even (+0.3 percent) on a seasonally adjusted basis.

Inventories of pipe and tube ended the month at 719,200 tons up from the 700,700 tons carried by the domestic service centers at the end of November and 18.1 percent above the 609,300 tons carried at the end of December 2011. The MSCI calculates the industry has 3.6 months of inventory on their floors on an unadjusted basis (+0.3 months) and 3.0 months (no change) on a seasonally adjusted basis.