Product

January 11, 2013

IHS Steel Economist Says It Is a Buyer’s Market

Written by Sandy Williams

Written by: Sandy Williams

Steel prices and buyers risks were discussed by John Anton, Director of IHS Steel Service, on Wednesday in the 2013 Steel Buyers Guide a webinar presentation by IHS Global Insight. Anton says right now it is a buyer’s market and there are significant savings to be had for those willing to shop the market. The market, however, is beginning to shift to neutral and will be more balanced in the future. Supply is good for every product.

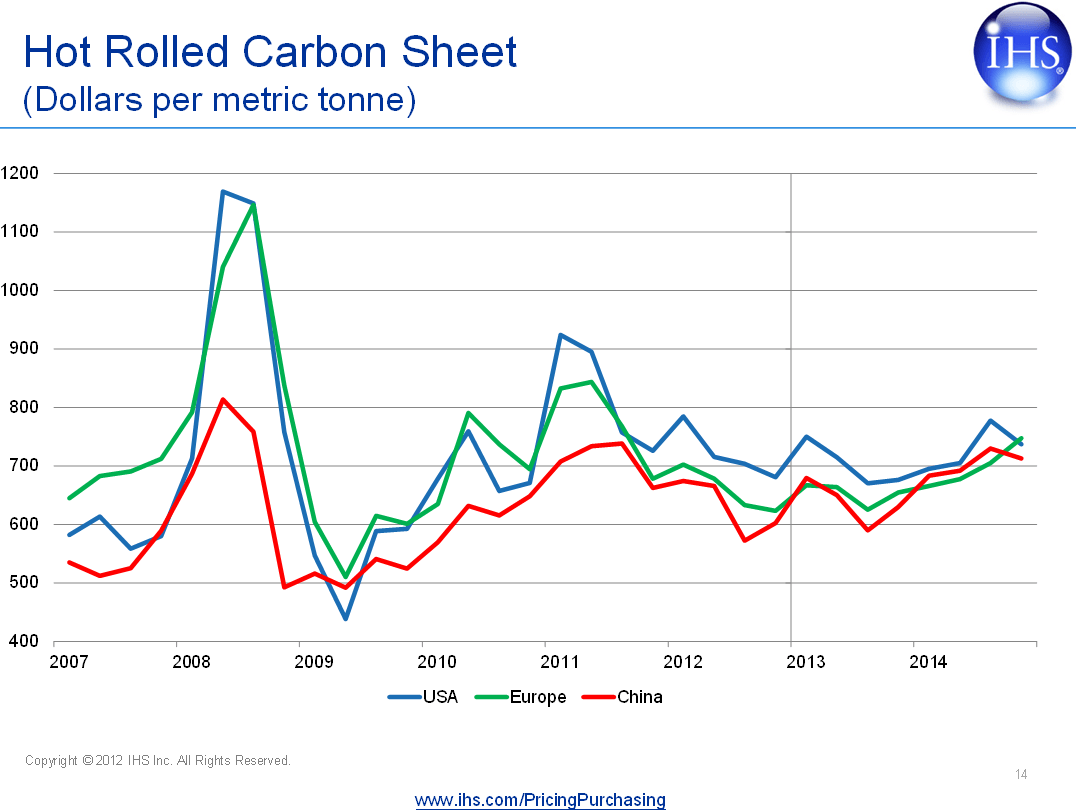

Anton said declining output at the end of 2012 will cause supply to start tightening in early 2013 allowing prices to rally. China, and probably the U.S., will boost prices higher than the market can bear in the first quarter of 2013 and begin ramping up capacity. The increase in output will cause prices to crash by third quarter, or even earlier in the second, into the $600mt range ($544 net ton) and be followed by more production cuts in late 2013, ending with prices somewhere between $700mt and $750mt by late 2014 ($635-$680 per net ton).

Currently the U.S. has the highest steel prices in the world except for Brazil which is nearly double. Europe prices are in the middle with China often $150mt lower than the U.S. and $70mt lower than Europe. Brazil prices are terrible, said Anton, due to protectionism. When prices for sheet were $400mt in the U.S. in 2009, Brazil prices were $1000mt and rising and never really came back down. Just recently there was some retreat, but Anton predicts prices will stay around $900-$1000mt.

China’s overproduction and high inventory are driving up raw materials and keeping steel prices low. China has cut production some but not enough, says Anton, and unless it makes deeper cuts soon, prices could peak in April and May and fall again by June or July.

Production in China is hovering near 800 million metric tons. There has been a 13-14 percent cut in production between the peak and current level. China made a run at $740mt and did same thing in 2011, but in 2011 between May and November, production fell 18 percent. Last year the peak fell but not as soon and at only 6 percent. China only needs to make about 600 million metric tons—it is making more steel than China and the world needs. Demand is not that strong and they are overproducing, selling at a loss and undercutting prices.

Chinese overproduction has been overwhelming U.S. production restraint. The U.S. steel industry, said Anton, has been very disciplined, realizing they can make a lot of tonnage and sell at a low price or make less and sell at a higher one. “Chinese steel makers are acting like idiots,” said Anton, “U.S. steelmakers are acting rationally.”

Anton recommends that if buyers can tolerate slower delivery times, there are bargains to be had by shopping around and going overseas. Overall steel prices are good but have been moving higher for several months. Either buy right now, he said, or wait six months because they will be coming back down soon.

In North America, carbon sheet product has had good demand from the auto industry but has been soft in the areas of appliances and other consumer durables.

Plate steel has been declining for some time and there is not a lot of gap in pricing said Anton. Plate has been in a slow steady decline and is about to hit bottom. When it goes up it will not be because of a boom in demand, but because it hit bottom and it is time to go up. Plate has been declining for almost two years–don’t count on it to go down anymore.

Market risks to beware of include the affect of weather on raw materials coming out of Australia. A cyclone is currently hovering near the west coast which may seriously threaten mining operations in the area. Anton said it is good practice to watch weather patterns that may affect production. “I don’t know if weather will be bad this year, but if it is, buy steel quick as you can, even if you have to borrow money or defer other projects.” He suggests buying enough for a three to six month supply.

Another risk is the possibility of Greece leaving the EU in 2013 or 2014. If Greece leaves in 2013, said Anton, the psychological affect will push prices up. A third risk is that if there is an over stimulus in China, prices may be driven higher.