Product

January 11, 2013

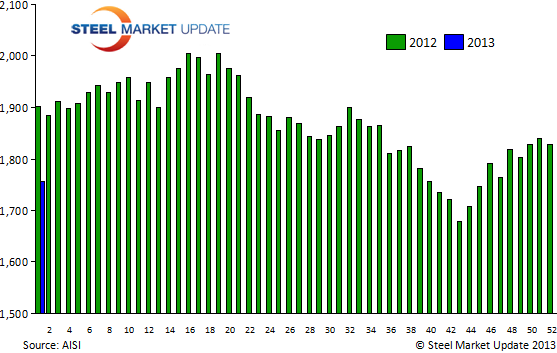

AISI Raw Steel Production New SMU Graphic

Written by John Packard

Based on the raw steel capability adjustment which was made by the American Iron and Steel Institute (AISI) as of the beginning of this year, SMU is adjusting the way we will present our visual data to our readers. We will begin to compare weekly production against the “revised” weekly production number from the comparable week from the prior year. As you can see by the graph below, the tonnage produced this past week is well below the tonnage produced one year ago. It is our opinion the existence of RG Steel had little to do with the production difference as those tons were easily absorbed by existing facilities along with the additional tons out of Severstal Columbus (new EAF).

Just to remind everyone – the AISI revised domestic mill capability for 1st Quarter 2013 to 30.8 million tons down from 32.7 million tons during 4th Quarter 2012 and down from 32.3 million tons compared to 1st Quarter 2012.