Product

January 9, 2013

SMU Price Ranges & Indices Slip $10 Per Ton

Written by John Packard

Hot Rolled Coil: SMU Range is $600-$650 per ton ($30.00/cwt-$32.50/cwt) with an average of $625 per ton ($31.25/cwt) fob mill, east of the Rockies. Both the upper and lower end of our range dropped $10 per ton from levels measured one week ago. Our average dropped $10 per ton compared to one week ago. The trend for HR continues to be “Neutral” which essentially means there is no clear cut direction associated with this market. The market is close to making a move below $600 per ton which could change the psychology of the market and push prices lower. Before that happens, the domestic mills may attempt to raise prices in order to prevent a wholesale decline from here.

Hot Rolled Coil: SMU Range is $600-$650 per ton ($30.00/cwt-$32.50/cwt) with an average of $625 per ton ($31.25/cwt) fob mill, east of the Rockies. Both the upper and lower end of our range dropped $10 per ton from levels measured one week ago. Our average dropped $10 per ton compared to one week ago. The trend for HR continues to be “Neutral” which essentially means there is no clear cut direction associated with this market. The market is close to making a move below $600 per ton which could change the psychology of the market and push prices lower. Before that happens, the domestic mills may attempt to raise prices in order to prevent a wholesale decline from here.

Hot Rolled Lead Times & Negotiations (see separate article below).

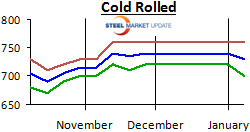

Cold Rolled Coil: SMU Range is $700-$760 per ton ($35.00/cwt-$38.00/cwt) with an average of $730 per ton ($36.50/cwt) fob mill, east of the Rockies. The lower end of our range moved lower by $20 per ton while the upper end of our range remained intact from one week ago. Our average adjusted lower by $10 per ton. The trend for CR is Neutral as the market searches for direction (see HR discussion above).

Cold Rolled Coil: SMU Range is $700-$760 per ton ($35.00/cwt-$38.00/cwt) with an average of $730 per ton ($36.50/cwt) fob mill, east of the Rockies. The lower end of our range moved lower by $20 per ton while the upper end of our range remained intact from one week ago. Our average adjusted lower by $10 per ton. The trend for CR is Neutral as the market searches for direction (see HR discussion above).

Cold Rolled Lead Times & Negotiations (see separate article below).

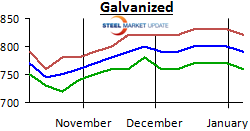

Galvanized Coil: SMU Base Price Range is $35.00/cwt-$38.00/cwt with an average of $36.50/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range dropped $10 per ton as did the upper end of our range and our average compared to one week ago. The trend is Neutral for galvanized which, like hot rolled and cold rolled, searches for market direction from here.

Galvanized Coil: SMU Base Price Range is $35.00/cwt-$38.00/cwt with an average of $36.50/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range dropped $10 per ton as did the upper end of our range and our average compared to one week ago. The trend is Neutral for galvanized which, like hot rolled and cold rolled, searches for market direction from here.

Galvanized .060” G90 Benchmark: SMU Range is $760-$820 with an average of $790 per ton.

Galvanized Lead Times & Negotiations (see separate article below).

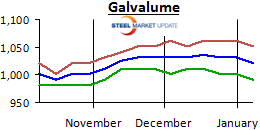

Galvalume Coil: SMU Base Price Range is $35.00/cwt-$38.00/cwt with an average of $36.50/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of the range is down $10 per ton as is the upper end of the range and our average compared to one week ago. The trend is Neutral for Galvalume much like all the other flat rolled products as the market searches for direction from here.

Galvalume Coil: SMU Base Price Range is $35.00/cwt-$38.00/cwt with an average of $36.50/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of the range is down $10 per ton as is the upper end of the range and our average compared to one week ago. The trend is Neutral for Galvalume much like all the other flat rolled products as the market searches for direction from here.

Galvalume .0142” AZ50 Grade 80 Benchmark: SMU Range is $991-$1051 per ton with an average of $1021 per ton.

Galvalume Lead Time & Negotiations (see separate article below).