Product

January 9, 2013

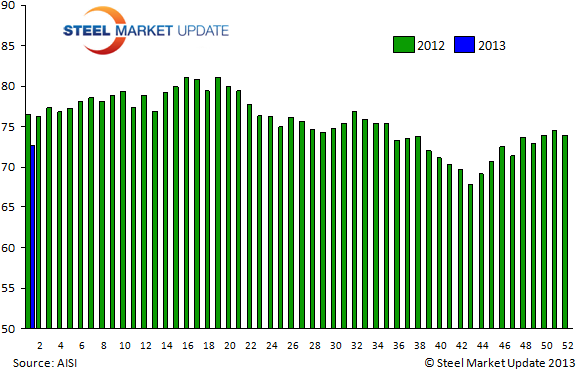

AISI Estimated Raw Steel Production & Capacity Utilization Rates

Written by John Packard

The American Iron & Steel Institute (AISI) reported their estimated raw steel production data for the week ending January 5, 2013. According to AISI estimates the U.S. steel industry produced 1,756,000 net tons of raw steel last week. This represents a decrease of 3.9 percent compared to the week earlier and is 7.7 percent lower than the same week one year ago.

The AISI estimates the capacity utilization rate to be 72.6 percent. The estimate is based on a much reduced maximum production rate of 30.8 million tons for the 1st Quarter 2013 down from 32.3 million tons from 1Q 2012 and 32.7 million tons for 4Q 2012. So, when you consider the production rate to be 7.7 percent less than one year ago remember the capacity was much higher at that time than it is currently. What is probably more relevant at this time is to compare total tons produce as opposed to capacity utilization rates.

The AISI estimates the capacity utilization rate to be 72.6 percent. The estimate is based on a much reduced maximum production rate of 30.8 million tons for the 1st Quarter 2013 down from 32.3 million tons from 1Q 2012 and 32.7 million tons for 4Q 2012. So, when you consider the production rate to be 7.7 percent less than one year ago remember the capacity was much higher at that time than it is currently. What is probably more relevant at this time is to compare total tons produce as opposed to capacity utilization rates.

Year to date the AISI estimates total raw steel produced to be 1,756,000 net tons, down 7.7 percent compared to the 1,902,000 tons produced through the same period last year.

The average capacity utilization rate is estimated to be 72.6 percent so far this year, down from 76.9 percent last year (however, read article above regarding reliability of comparisons of capacity utilization rates year-over-year).

The North East district produced 186,000 net tons, down 2,000 tons from the previous week.

The Great Lakes district produced 639,000 net tons, down 44,000 tons from the previous week.

The Midwest district produced 268,000 net tons, up 5,000 tons from the previous week.

The Southern district produced 581,000 net tons, down 31,000 tons from the previous week.

The Western district produced 82,000 net tons, up 1,000 tons from the previous week.

Total production was 1,756,000 net tons, down 71,000 tons from the previous week.