Product

January 7, 2013

Service Center Spot Prices Indicate Weaker than Normal Price Cycle

Written by John Packard

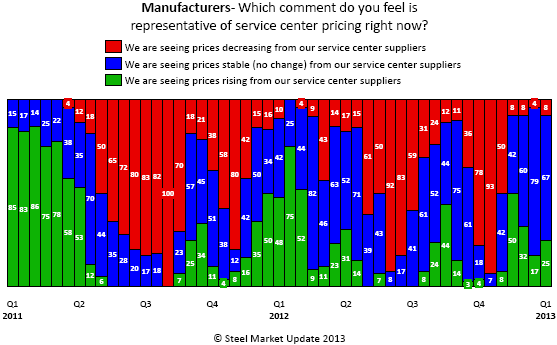

Manufacturing companies reported a slight uptick in service center spot prices – prices service centers are attempting to sell non-contract items to manufacturing companies on the open market – during the first week of January. Of the manufacturing companies responding to our survey, 25 percent – or a gain of 8 percentage points from the middle of December survey results – reported spot prices out of the distribution segment of the industry as rising. At the same time only 8 percent reported prices as decreasing up from 4 percent during the same time period. The balance reported spot prices as remaining the same.

Manufacturing companies reported a slight uptick in service center spot prices – prices service centers are attempting to sell non-contract items to manufacturing companies on the open market – during the first week of January. Of the manufacturing companies responding to our survey, 25 percent – or a gain of 8 percentage points from the middle of December survey results – reported spot prices out of the distribution segment of the industry as rising. At the same time only 8 percent reported prices as decreasing up from 4 percent during the same time period. The balance reported spot prices as remaining the same.

What is interesting is to compare the results from our latest survey against the past two beginning of the year cycles to see how they compare. During the beginning of 2011 the steel industry went through a very strong spot market and pricing cycle and at the time manufacturing companies were consistently reporting throughout the entire first quarter higher spot prices from the service center segment of the industry. During the first week of January 2011, 85 percent of the manufacturing companies reported service centers as raising spot prices.

The early January cycle 2012 was different than the previous year in that only 48 percent of the manufacturing companies reported spot prices as rising – this was slightly lower than the 50 percent from two weeks prior and well below the 85 percent levels of 2011. During the middle of January the percentage did rise to 75 percent before dropping to 9 percent by the middle of the following month. According to SMU price assessment data the domestic mills were unable to keep momentum for higher prices moving in their favor and prices began moving lower by the end of January 2012.

Since the short history of our survey (Fall 2008) with the exception of the Great Recession 2008/2009 we have not seen a period of time when spot prices came off during 4th quarter as they did during this past year. Nor have we seen a year during our limited time doing this survey when steel service centers have had such limited pricing power going into the 1st quarter as we are seeing at this time.

The expectation amongst many within the industry is for the steel mills and service centers to mount some form of offensive within the next few days to try to gain the upper hand on pricing. We have heard of at least one mill in the Midwest raising spot prices to their service center customers by $10 per ton in expectation of higher scrap prices this week. But the service center who confided in SMU about the increase was not inclined to pay the increase until such time as business dictated a need to do so. This service center executive, who purchases galvanized steel, pointed to his 3.5 months worth of inventory and to a couple of the conversion mills whose business he called “completely dead” and did not feel the need to make any moves right now.

Many within the industry feel this coming week – the week of January 7th – will be a key week to see if the domestic mills can move prices higher and the service centers can do the same on the spot market. The two really need to work hand in hand because there is no use selling replacement tons at higher prices if you can’t sell the inventory you already have on the floor.