Product

January 4, 2013

Global PMI Breaks Past Neutral Point to 50.2

Written by Sandy Williams

Written by: Sandy Williams

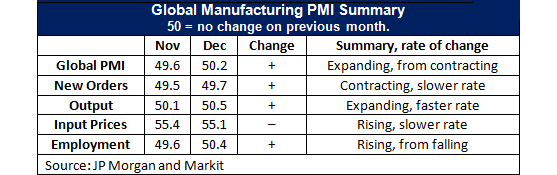

The JP Morgan Global Manufacturing PMI rating increased to 50.2 in December from 49.6 last month according to data released in a composite index produced by JPMorgan and Markit in association with ISM and IFPSM. It is the first time the index has been above the neutral mark of 50.0 since May 2012.

Global output expanded slightly from 50.1 to 50.5 with solid gains in the U.S, China and U.K. Emerging markets fared well while growth in Russia and Vietnam stagnated. South Korea and Taiwan showed signs of stabilization after six months of contraction.

In Europe and Japan, output and employment both contracted. Employment rose in the U.S. Canada, India, Taiwan, Turkey, Ireland and Vietnam and was mostly flat in China, the U.K., South Korea and Brazil. Overall, global employment rose to 50.4 in December from 49.6 last month.

New export orders declined for the ninth successive month but the contraction was at the slowest rate since May 2012. Inventories still appear lean and average input prices continued to show growth, but at a slower pace.

“PMI survey indices for output, new orders and employment continued to lift at the end of 2012, as the global manufacturing sector stabilizes following a softer patch in the middle of the year. With the rate of inventory accumulation also remaining low, the sector should, barring any disruptions, advance further into expansion territory at the start of 2013,” said David Hensley, Director of Global Economics Coordination at JPMorgan

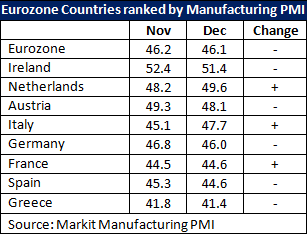

In the Eurozone, recession continued to deepen as 2012 closed, with all nations except Ireland reporting manufacturing contractions. The Markit Final Eurozone Manufacturing PMI was at 46.1 in December, down from 46.2 in November and less than the original flash estimate of 46.3. December marked the seventeenth month of contraction for the Eurozone. Production was down for the tenth successive month as new orders and exports continued to decline, although at a slower pace from first quarter last year. France, Italy and the Netherlands showed some improvement but Greece continues to perform well below any other Eurozone nation.

Chris Williamson, Chief Economist at Markit said, “The Eurozone manufacturing sector remained entrenched in a steep downturn at the end of the year. Although not as severe as in the autumn, the survey indicates that production continued to fall at a quarterly rate of approximately 1% in December, therefore acting as a severe drag on the wider economy. The region’s recession therefore looks likely to have deepened, possibly quite significantly, in the final quarter.”

Williamson said prospects for producers should improve as import demand grows stronger in the U.S. and China but warns that the evolving debt crisis and any set-backs could offset export market gains.

China operating conditions improved in December at the fastest rate in 19 months according to the HSBC China Manufacturing PMI. After adjusting for seasonal factors, HSBC posted a 51.5 in December, up from 50.5 in November, the highest index reading for China since May 2011.

China operating conditions improved in December at the fastest rate in 19 months according to the HSBC China Manufacturing PMI. After adjusting for seasonal factors, HSBC posted a 51.5 in December, up from 50.5 in November, the highest index reading for China since May 2011.

Output and new orders both expanded at quickened paces in December. Export orders fell slightly from November due to weak demand in Europe, Japan and the U.S. Nearly 85 percent of surveyed respondents reported no change in the level of outstanding business and no significant changes were noted in workforce numbers. Lead times lengthened in December for the third time. Input prices and output charges both rose, as did average tariffs. Purchasing activity markedly increased from November and rose for the third consecutive month.

Japan saw its sharpest contractions of output and new orders in 20 months according to December data from the Markit/JMMA Manufacturing PMI. After adjusting for seasonal factors, the PMI level for December registered at 45.0 down from 46.5 in November and a 44-month low. Employment, purchasing and inventory all declined in December. Total manufacturing production fell for the seventh month in a row. Exports orders fell as demand remained sluggish from Chinese and European markets.

“Japan’s manufacturing sector continued to struggle against the dual headwinds of weak domestic and external demand forces during December. Output declined at a marked rate, but it was the severity of the fall in new orders that was particularly worrying, especially for capital goods,” said Paul Smith, Senior Economist at Markit and author of the Japan report. “With Japan already in technical recession, this latest set of figures will do little to suggest that the economy has shown any underlying performance improvement in the final months of the year.”

South Korea saw stabilization of manufacturing conditions in December as reflected by an HSBC South Korea Manufacturing PMI rating of 50.1, up from November’s 48.2 and the highest rating since May. However, because the rating is so close to the neutral point of 50.0, the PMI suggests that there was negligible change from November. Weak levels of output, new orders and employment were reported. An uncertain economic outlook has led to lean inventories of pre- and post-production goods. Manufactures discounted output charges in December to sustain sales. Nevertheless, the upward PMI momentum is expected to be sustainable in 2013 according to Ronald Man, Economist at HSBC in Asia.

Vietnam dropped to an HSBC Manufacturing PMI of 49.3 in December, down from 50.5 in November—the eighth time below the 50.0 mark in nine months. Manufacturing output stagnated as new orders fell and production was sustained by depletion of backlogs of work. A slight reduction in input prices was reported as demand weakened for raw materials.

“The economy is stabilizing, as indicated by the output level,” said Trinh Nguyen, Asia Economist at HSBC. “However, the economic recovery process is still in its fragile state as external demand remains weak and consumer confidence is subdued. Price discounting measures are being helped by a reduction of input prices.” Nguyen added, “Still, while things will likely improve marginally next year, significant changes to consumption behavior are not expected unless meaningful reforms take place.”

India rose to an HSBC Manufacturing PMI of 54.7 in December, up from 53.7 in November. New orders increased at the fastest rate in six months. There was a slight increase in employment reported but survey respondents reported labor shortages and a demand for higher salaries held back new hires. Manufacturers reported persistent power outages contributed to higher backlogs of work during December. Purchasing activity was reported up for forty-fifth successive month.

“Activity in the manufacturing sector picked up again led by faster output growth and a further uptick in new orders, which led to a faster increase in backlogs of work as companies struggled to keep up with demand,” said Leif Eskesen, Chief Economist for India & ASEAN at HSBC. “Moreover, final goods inventories’ depletion continued, which suggests that output growth is likely to hold up in coming months. Inflation only eased marginally and survey respondents noted price pressures from rising raw material costs, firm demand, and the depreciated exchange rate. With growth picking up led by firmer demand, inflation pressures are likely to remain firm in coming months.”

Russia earned an HSBC Manufacturing PMI of 50.0 in December, ending 15 consecutive months above the neutral point of 50.0 and below November’s rating of 52.2. New orders rose for the fifteenth month but at the lowest pace in four months. New exports declined for the third time in five months, and at the fastest pace since October 2010. Employment fell at the fastest rate since August 2009.

“Growth momentum suddenly deteriorated amid a sharp fall in external demand in the end of 2012. Yet, the latter happened three times in the past five months casting doubt on hopes that industry is benefiting from improvement in global demand,” said Artem Biryukov, Economist (Russia and CIS) at HSBC. “Stabilisation, not stagnation – this is how we interpret the results of December HSBC Russia Manufacturing PMI release.”

Brazil continued to see a rise in production output during December. The HSBC Brazil Manufacturing PMI showed a slowing of growth in the manufacturing sector with a post of 51.1 in December, down from 52.2 in November. Input inflation continued to persist in Brazil with the pace of inflation in December at the fastest rate in 18 months. New orders increased moderately along with new exports. Higher input costs are being passed to clients as output prices rose at the fastest rate in three months. Inventories fell somewhat in December and poor highway conditions continued to affect lead times.

Mexico had its highest HSBC Manufacturing PMI rating in its 21 months of data collection, a strong 57.1 in December up from 55.6 in November. Mexican manufacturers reported a sharp rise in new orders and a survey record for output growth. Input costs rose in December, but at the slowest inflation rate in 21 months. Employment continued to grow, although slower last month, with 10 percent of firms adding hiring additional staff since November. Positive growth has led to a GDP growth forecast of 3.2 percent for 2013.

Canada showed only marginal improvement in manufacturing conditions in December with an RBC Canadian Manufacturing PMI of 50.4, the same as in November. New orders increased in December due to greater demand and new product launches but output levels were primarily unchanged from the previous month. Employment and input prices continued to increase but a slower pace.

“A weak global economy and a strong loonie have weighed somewhat on the broader sector and contributed to a flat PMI reading compared to November,” said Craig Wright, senior vice-president and chief economist, RBC. “That said, as the cloak of uncertainty is removed from the global economy in the coming months related to fiscal policy in the U.S. and elsewhere, we expect that demand for Canadian exports will rise, as will investment and hiring across the economy.”

The Manufacturing Purchasing Managers’ Index is a composite indicator designed to provide an overall view of activity in the manufacturing sector and acts as a leading indicator for the whole economy. The indicator is derived from individual diffusion indices which measure changes in output, new orders, employment, suppliers’ delivery times and stocks of goods purchased. A reading of the PMI below 50.0 indicates that the manufacturing economy is generally declining; above 50.0, that it is generally expanding. A reading of 50.0 signals no change.