Product

January 4, 2013

December Disappoints

Written by John Packard

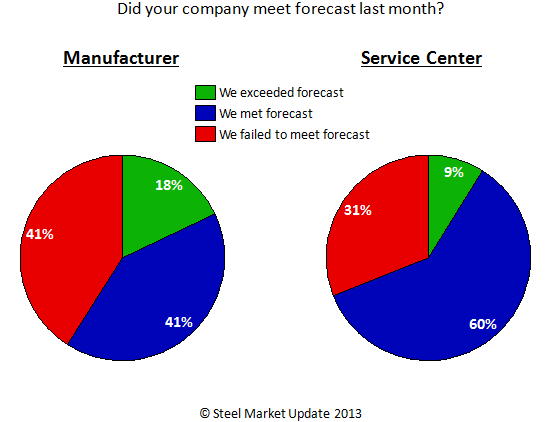

We have begun our first steel market survey for the New Year. Early results are showing December business conditions as having been less than what was expected by both manufacturing companies and the distributors who service those businesses. After two days of collection, our preliminary results are showing 41 percent of the manufacturing companies as reporting their company as not having met forecast for the month. Service centers fared slightly better with 31 percent of those responding to the survey reporting failure to meet their December forecast.

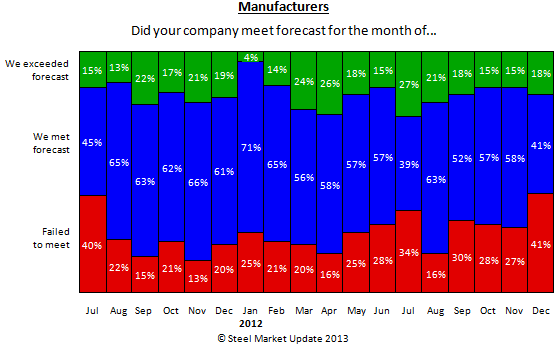

When looking at the responses we have received from the manufacturing companies we found the 41 percent reporting failing to meet forecast response rate to be the highest rate over the past 18 months and twice the rate we saw one year ago (20 percent).

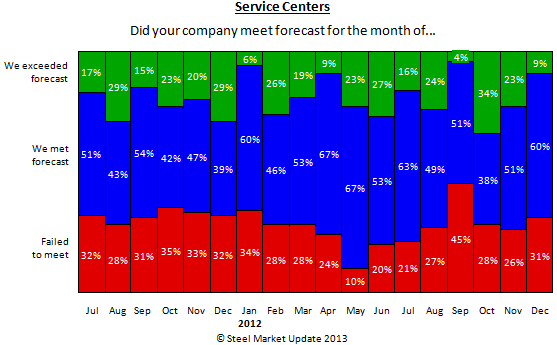

Service centers results were more negative – but the real emphasis was in the reduction of those responding that their company had exceeded forecast. We saw the percentages drop from 34 percent in October, to 23 percent in November and now 9 percent during the month of December. At the same time those failing to meet forecast has grown slightly during the same time period from 28 percent to 31 percent but is still far below the 45 percent we measured during the month of September.